Page 6 - AFL 2022 Grandfathered Guide with Legal Notices

P. 6

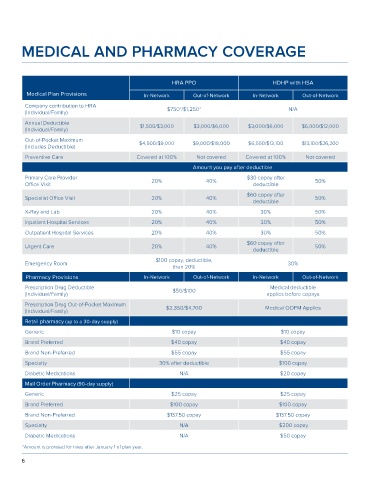

MEDICAL AND PHARMACY COVERAGE

HRA PPO HDHP with HSA

Medical Plan Provisions In-Network Out-of-Network In-Network Out-of-Network

Company contribution to HRA 2 2

(Individual/Family) $750 /$1,250 N/A

Annual Deductible $1,500/$3,000 $3,000/$6,000 $3,000/$6,000 $6,000/$12,000

(Individual/Family)

Out-of-Pocket Maximum $4,500/$9,000 $9,000/$18,000 $6,550/$13,100 $13,100/$26,200

(Includes Deductible)

Preventive Care Covered at 100% Not covered Covered at 100% Not covered

Amount you pay after deductible

Primary Care Provider 20% 40% $30 copay after 50%

Office Visit deductible

$60 copay after

Specialist Office Visit 20% 40% 50%

deductible

X-Ray and Lab 20% 40% 30% 50%

Inpatient Hospital Services 20% 40% 30% 50%

Outpatient Hospital Services 20% 40% 30% 50%

$60 copay after

Urgent Care 20% 40% 50%

deductible

$100 copay, deductible,

Emergency Room 30%

then 20%

Pharmacy Provisions In-Network Out-of-Network In-Network Out-of-Network

Prescription Drug Deductible $50/$100 Medical deductible

(Individual/Family) applies before copays

Prescription Drug Out-of-Pocket Maximum

(Individual/Family) $2,350/$4,700 Medical OOPM Applies

Retail pharmacy (up to a 30-day supply)

Generic $10 copay $10 copay

Brand Preferred $40 copay $40 copay

Brand Non-Preferred $55 copay $55 copay

Specialty 30% after deductible $100 copay

Diabetic Medications N/A $20 copay

Mail Order Pharmacy (90-day supply)

Generic $25 copay $25 copay

Brand Preferred $100 copay $100 copay

Brand Non-Preferred $137.50 copay $137.50 copay

Specialty N/A $200 copay

Diabetic Medications N/A $50 copay

2 Amount is prorated for hires after January 1 of plan year.

6