Page 120 - 2022 Washington Nationals Flipbook

P. 120

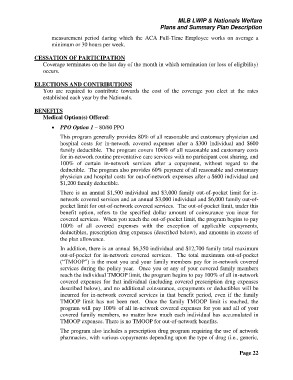

MLB LWIP & Nationals Welfare

Plans and Summary Plan Description

measurement period during which the ACA Full-Time Employee works on average a

minimum or 30 hours per week.

CESSATION OF PARTICIPATION

Coverage terminates on the last day of the month in which termination (or loss of eligibility)

occurs.

ELECTIONS AND CONTRIBUTIONS

You are required to contribute towards the cost of the coverage you elect at the rates

established each year by the Nationals.

BENEFITS

Medical Option(s) Offered:

PPO Option 1 – 80/60 PPO

This program generally provides 80% of all reasonable and customary physician and

hospital costs for in-network covered expenses after a $300 individual and $600

family deductible. The program covers 100% of all reasonable and customary costs

for in-network routine preventative care services with no participant cost sharing, and

100% of certain in-network services after a copayment, without regard to the

deductible. The program also provides 60% payment of all reasonable and customary

physician and hospital costs for out-of-network expenses after a $600 individual and

$1,200 family deductible.

There is an annual $1,500 individual and $3,000 family out-of-pocket limit for in-

network covered services and an annual $3,000 individual and $6,000 family out-of-

pocket limit for out-of-network covered services. The out-of-pocket limit, under this

benefit option, refers to the specified dollar amount of coinsurance you incur for

covered services. When you reach the out-of-pocket limit, the program begins to pay

100% of all covered expenses with the exception of applicable copayments,

deductibles, prescription drug expenses (described below), and amounts in excess of

the plan allowance.

In addition, there is an annual $6,350 individual and $12,700 family total maximum

out-of-pocket for in-network covered services. The total maximum out-of-pocket

(“TMOOP”) is the most you and your family members pay for in-network covered

services during the policy year. Once you or any of your covered family members

reach the individual TMOOP limit, the program begins to pay 100% of all in-network

covered expenses for that individual (including covered prescription drug expenses

described below), and no additional coinsurance, copayments or deductibles will be

incurred for in-network covered services in that benefit period, even if the family

TMOOP limit has not been met. Once the family TMOOP limit is reached, the

program will pay 100% of all in-network covered expenses for you and all of your

covered family members, no matter how much each individual has accumulated in

TMOOP expenses. There is no TMOOP for out-of-network benefits.

The program also includes a prescription drug program requiring the use of network

pharmacies, with various copayments depending upon the type of drug (i.e., generic,

Page 22