Page 5 - 2022 Benefit Guide NA Construction

P. 5

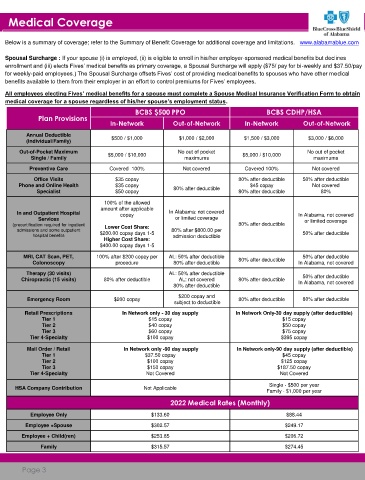

Medical Coverage

.express-scripts.com/

Below is a summary of coverage; refer to the Summary of Benefit Coverage for additional coverage and limitations. www.alabamablue.com

Spousal Surcharge : If your spouse (i) is employed, (ii) is eligible to enroll in his/her employer-sponsored medical benefits but declines

enrollment and (iii) elects Fives’ medical benefits as primary coverage, a Spousal Surcharge will apply ($75/ pay for bi-weekly and $37.50/pay

for weekly-paid employees.) The Spousal Surcharge offsets Fives’ cost of providing medical benefits to spouses who have other medical

benefits available to them from their employer in an effort to control premiums for Fives’ employees.

All employees electing Fives’ medical benefits for a spouse must complete a Spouse Medical Insurance Verification Form to obtain

medical coverage for a spouse regardless of his/her spouse’s employment status.

BCBS $500 PPO BCBS CDHP/HSA

Plan Provisions

In-Network Out-of-Network In-Network Out-of-Network

Annual Deductible $500 / $1,000 $1,000 / $2,000 $1,500 / $3,000 $3,000 / $6,000

(Individual/Family)

Out-of-Pocket Maximum $5,000 / $10,000 No out of pocket $5,000 / $10,000 No out of pocket

Single / Family maximums maximums

Preventive Care Covered 100% Not covered Covered 100% Not covered

Office Visits $35 copay 80% after deductible 50% after deductible

Phone and Online Health $35 copay 80% after deductible $45 copay Not covered

Specialist $50 copay 80% after deductible 80%

100% of the allowed

amount after applicable

In and Outpatient Hospital copay In Alabama: not covered In Alabama, not covered

Services or limited coverage or limited coverage

(precertification required for inpatient Lower Cost Share: 80% after deductible

admissions and some outpatient 80% after $800.00 per

hospital benefits $200.00 copay days 1-5 admission deductible 50% after deductible

Higher Cost Share:

$400.00 copay days 1-5

MRI, CAT Scan, PET, 100% after $200 copay per AL: 50% after deductible 80% after deductible 50% after deductible

Colonoscopy procedure 80% after deductible In Alabama, not covered

Therapy (30 visits) AL: 50% after deductible

50% after deductible

Chiropractic (15 visits) 80% after deductible AL: not covered 80% after deductible In Alabama, not covered

80% after deductible

$200 copay and

Emergency Room $200 copay 80% after deductible 80% after deductible

subject to deductible

Retail Prescriptions In Network only - 30 day supply In Network Only-30 day supply (after deductible)

Tier 1 $15 copay $15 copay

Tier 2 $40 copay $50 copay

Tier 3 $60 copay $75 copay

Tier 4-Specialty $100 copay $395 copay

Mail Order / Retail In Network only -90 day supply In Network only-90 day supply (after deductible)

Tier 1 $37.50 copay $45 copay

Tier 2 $100 copay $125 copay

Tier 3 $150 copay $187.50 copay

Tier 4-Specialty Not Covered Not Covered

(bi-weekly)

Single - $500 per year

HSA Company Contribution Not Applicable

Family - $1,000 per year

2022 Medical Rates (Monthly)

Employee Only $133.60 $88.44

Employee +Spouse $302.57 $249.17

Employee + Child(ren) $253.85 $206.72

Family $315.57 $274.45

Page 3