Page 14 - 2022 Benefit Guide DyAG

P. 14

Life and AD&D Insurance

Life insurance is an important part of your financial security, especially if others depend on you for support. Accidental Death &

Dismemberment (AD&D) insurance is designed to provide a benefit in the event of accidental death or dismemberment.

The Company provides Basic Life and AD&D Insurance to all eligible employees at no cost to you.

This benefit is one times your annual base earnings rounded up to the nearest $1,000, up to a maximum benefit of $350,000.

Disability Insurance

The Company’s Disability Insurance Plan is to provide you financial protection with income replacement should you become

disabled and unable to work due to a non-work-related illness or injury. The Plan is administered by Voya Financial.

New Hires: Benefits begin the 1 of the month after 90 days.

st

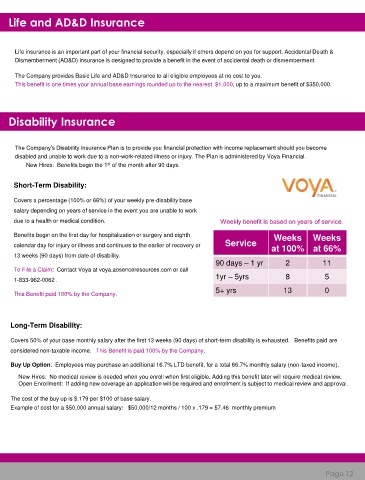

Short-Term Disability:

Covers a percentage (100% or 66%) of your weekly pre-disability base

salary depending on years of service in the event you are unable to work

due to a health or medical condition.

Benefits begin on the first day for hospitalization or surgery and eighth Weeks Weeks

calendar day for injury or illness and continues to the earlier of recovery or Service

at 100% at 66%

13 weeks (90 days) from date of disability.

90 days – 1 yr 2 11

To File a Claim: Contact Voya at voya.absenceresources.com or call

1yr – 5yrs 8 5

1-833-962-0062 .

5+ yrs 13 0

This Benefit paid 100% by the Company.

Long-Term Disability:

Covers 50% of your base monthly salary after the first 13 weeks (90 days) of short-term disability is exhausted. Benefits paid are

considered non-taxable income. This Benefit is paid 100% by the Company.

Buy Up Option: Employees may purchase an additional 16.7% LTD benefit, for a total 66.7% monthly salary (non-taxed income).

New Hires: No medical review is needed when you enroll when first eligible. Adding this benefit later will require medical review.

Open Enrollment: If adding new coverage an application will be required and enrollment is subject to medical review and approval.

The cost of the buy up is $.179 per $100 of base salary.

Example of cost for a $50,000 annual salary: $50,000/12 months / 100 x .179 = $7.46 monthly premium

Page 12