Page 160 - Washington Nationals 2023 Benefits Guide -10.26.22_Neat

P. 160

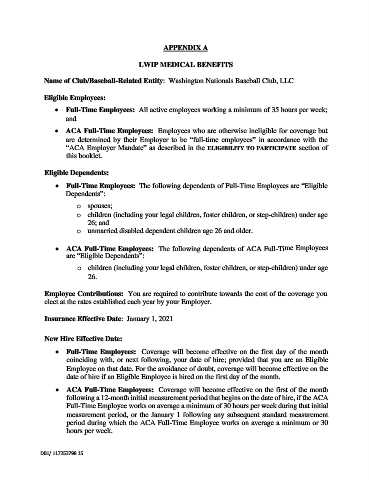

APPENDIX A

LWIP MEDICAL BENEFITS

Name of Club/Baseball-Related Entity: Washington Nationals Baseball Club, LLC

Eligible Employees:

• Full-Time Employees: All active employees working a minimum of 35 hours per week;

and

• ACA Full-Time Employees: Employees who are otherwise ineligible for coverage but

are determined by their Employer to be “full-time employees” in accordance with the

“ACA Employer Mandate” as described in the ELIGIBILITY TO PARTICIPATE section of

this booklet.

Eligible Dependents:

• Full-Time Employees: The following dependents of Full-Time Employees are “Eligible

Dependents”:

o spouses;

o children (including your legal children, foster children, or step-children) under age

26; and

o unmarried disabled dependent children age 26 and older.

• ACA Full-Time Employees: The following dependents of ACA Full-Time Employees

are “Eligible Dependents”:

o children (including your legal children, foster children, or step-children) under age

26.

Employee Contributions: You are required to contribute towards the cost of the coverage you

elect at the rates established each year by your Employer.

Insurance Effective Date: January 1, 2021

New Hire Effective Date:

• Full-Time Employees: Coverage will become effective on the first day of the month

coinciding with, or next following, your date of hire; provided that you are an Eligible

Employee on that date. For the avoidance of doubt, coverage will become effective on the

date of hire if an Eligible Employee is hired on the first day of the month.

• ACA Full-Time Employees: Coverage will become effective on the first of the month

following a 12-month initial measurement period that begins on the date of hire, if the ACA

Full-Time Employee works on average a minimum of 30 hours per week during that initial

measurement period, or the January 1 following any subsequent standard measurement

period during which the ACA Full-Time Employee works on average a minimum or 30

hours per week.

DB1/ 117253798.15