Page 161 - Washington Nationals 2023 Benefits Guide -10.26.22_Neat

P. 161

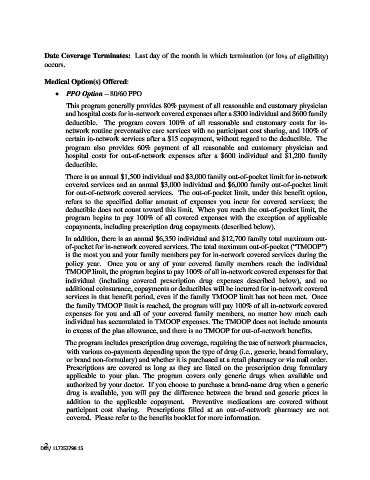

Date Coverage Terminates: Last day of the month in which termination (or loss of eligibility)

occurs.

Medical Option(s) Offered:

• PPO Option – 80/60 PPO

This program generally provides 80% payment of all reasonable and customary physician

and hospital costs for in-network covered expenses after a $300 individual and $600 family

deductible. The program covers 100% of all reasonable and customary costs for in-

network routine preventative care services with no participant cost sharing, and 100% of

certain in-network services after a $15 copayment, without regard to the deductible. The

program also provides 60% payment of all reasonable and customary physician and

hospital costs for out-of-network expenses after a $600 individual and $1,200 family

deductible.

There is an annual $1,500 individual and $3,000 family out-of-pocket limit for in-network

covered services and an annual $3,000 individual and $6,000 family out-of-pocket limit

for out-of-network covered services. The out-of-pocket limit, under this benefit option,

refers to the specified dollar amount of expenses you incur for covered services; the

deductible does not count toward this limit. When you reach the out-of-pocket limit, the

program begins to pay 100% of all covered expenses with the exception of applicable

copayments, including prescription drug copayments (described below).

In addition, there is an annual $6,350 individual and $12,700 family total maximum out-

of-pocket for in-network covered services. The total maximum out-of-pocket (“TMOOP”)

is the most you and your family members pay for in-network covered services during the

policy year. Once you or any of your covered family members reach the individual

TMOOP limit, the program begins to pay 100% of all in-network covered expenses for that

individual (including covered prescription drug expenses described below), and no

additional coinsurance, copayments or deductibles will be incurred for in-network covered

services in that benefit period, even if the family TMOOP limit has not been met. Once

the family TMOOP limit is reached, the program will pay 100% of all in-network covered

expenses for you and all of your covered family members, no matter how much each

individual has accumulated in TMOOP expenses. The TMOOP does not include amounts

in excess of the plan allowance, and there is no TMOOP for out-of-network benefits.

The program includes prescription drug coverage, requiring the use of network pharmacies,

with various co-payments depending upon the type of drug (i.e., generic, brand formulary,

or brand non-formulary) and whether it is purchased at a retail pharmacy or via mail order.

Prescriptions are covered as long as they are listed on the prescription drug formulary

applicable to your plan. The program covers only generic drugs when available and

authorized by your doctor. If you choose to purchase a brand-name drug when a generic

drug is available, you will pay the difference between the brand and generic prices in

addition to the applicable copayment. Preventive medications are covered without

participant cost sharing. Prescriptions filled at an out-of-network pharmacy are not

covered. Please refer to the benefits booklet for more information.

2

DB1/ 117253798.15