Page 16 - On Location 2022 Benefit Guide

P. 16

Flexible Spending Account (FSA)

Account Available to you:

• Healthcare FSA (with Debit Card) with $500 rolloverrate

• Dependent Care FSA

Eligibility:

When you use FSAs you can use tax-free dollars to pay for:

• Most medical, dental and vision care expenses like co-payments, deductibles and coinsurance

• Over-the-counter drugs – these items are ineligible expenses unless you have a prescription from yourphysician

• Dependent care (for children under 13 years old and/or parents or dependents that cannot care for themselves)

such as day care programs, babysitters, after-school programs, and adult day programs

Using tax-free dollars means that you spend less for these things and have more money to spend on other things that you

want and need.

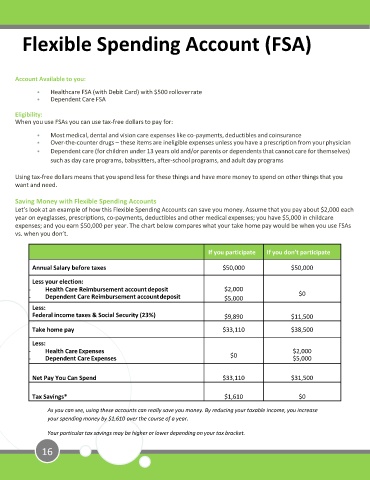

Saving Money with Flexible Spending Accounts

Let’s look at an example of how this Flexible Spending Accounts can save you money. Assume that you pay about $2,000 each

year on eyeglasses, prescriptions, co-payments, deductibles and other medical expenses; you have $5,000 in childcare

expenses; and you earn $50,000 per year. The chart below compares what your take home pay would be when you use FSAs

vs. when you don’t.

If you participate If you don’t participate

Annual Salary before taxes $50,000 $50,000

Less your election:

- Health Care Reimbursement accountdeposit $2,000

- Dependent Care Reimbursement accountdeposit $5,000 $0

Less:

Federal income taxes & Social Security (23%) $9,890 $11,500

Take home pay $33,110 $38,500

Less:

- Health Care Expenses $2,000

- Dependent CareExpenses $0 $5,000

Net Pay You Can Spend $33,110 $31,500

Tax Savings* $1,610 $0

As you can see, using these accounts can really save you money. By reducing your taxable income, you increase

your spending money by $1,610 over the course of a year.

Your particular tax savings may be higher or lower depending on your tax bracket.

16