Page 4 - Benefit Guide - SIPS - Non NY 2019 Revised 032520

P. 4

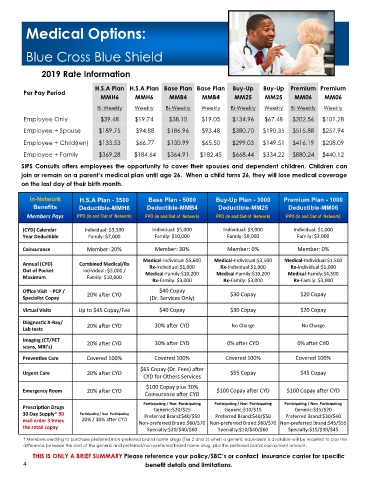

Medical Options:

Blue Cross Blue Shield

2019 Rate Information

H.S.A Plan H.S.A Plan Base Plan Base Plan Buy-Up Buy-Up Premium Premium

Per Pay Period

MMH6 MMH6 MMB4 MMB4 MM25 MM25 MM06 MM06

Bi-Weekly Weekly Bi-Weekly Weekly Bi-Weekly Weekly Bi-Weekly Weekly

Employee Only $39.48 $19.74 $38.10 $19.05 $134.96 $67.48 $202.56 $101.28

Employee + Spouse $189.75 $94.88 $186.96 $93.48 $380.70 $190.35 $515.88 $257.94

Employee + Child(ren) $133.53 $66.77 $130.99 $65.50 $299.03 $149.51 $416.19 $208.09

Employee + Family $369.28 $184.64 $364.91 $182.45 $668.44 $334.22 $880.24 $440.12

SIPS Consults offers employees the opportunity to cover their spouses and dependent children. Children can

join or remain on a parent’s medical plan until age 26. When a child turns 26, they will lose medical coverage

on the last day of their birth month.

In-Network H.S.A Plan - 3500 Base Plan - 5000 Buy-Up Plan - 3000 Premium Plan - 1000

Benefits Deductible-MMH6 Deductible-MMB4 Deductible-MM25 Deductible-MM06

Members Pays PPO (In and Out of Network) PPO (In and Out of Network) PPO (In and Out of Network) PPO (In and Out of Network)

(CYD) Calendar Individual: $3,500 Individual: $5,000 Individual: $3,000 Individual: $1,000

Year Deductible Family: $7,000 Family: $10,000 Family: $9,000 Family: $3,000

Coinsurance Member: 20% Member: 30% Member: 0% Member: 0%

Medical-Individual:$5,600 Medical-Individual:$3,500 Medical-Individual:$1,500

Annual (CYD) Combined Medical/Rx Rx-Individual:$1,000 Rx-Individual:$1,000 Rx-Individual:$1,000

Out of Pocket Individual: $5,000 / Medical-Family:$10,200 Medical-Family:$10,200 Medical-Family:$4,500

Maximum Family: $10,000

Rx-Family: $3,000 Rx-Family: $3,000 Rx-Family: $3,000

Office Visit - PCP / $40 Copay $30 Copay $20 Copay

Specialist Copay 20% after CYD (Dr. Services Only)

Virtual Visits Up to $45 Copay/Fee $40 Copay $30 Copay $20 Copay

Diagnostic X-Ray/ 20% after CYD 30% after CYD No Charge No Charge

Lab tests

Imaging (CT/PET 20% after CYD 30% after CYD 0% after CYD 0% after CYD

scans, MRI’s)

Preventive Care Covered 100% Covered 100% Covered 100% Covered 100%

$65 Copay (Dr. Fees) after

Urgent Care 20% after CYD $55 Copay $45 Copay

CYD for Others Services

$100 Copay plus 30%

Emergency Room 20% after CYD $100 Copay after CYD $100 Copay after CYD

Coinsurance after CYD

Participating / Non Participating Participating / Non Participating Participating / Non Participating

Prescription Drugs Generic:$20/$25 Generic:$10/$15 Generic:$15/$20

30 Day Supply* 90 Participating / Non Participating Preferred Brand:$40/$50 Preferred Brand:$40/$50 Preferred Brand:$30/$40

mail order 3 times 20% / 30% after CYD Non-preferred Brand:$60/$70 Non-preferred Brand:$60/$70 Non-preferred Brand:$45/$55

the retail copay

Specialty:$20/$40/$60 Specialty:$10/$40/$60 Specialty:$15/$30/$45

* Members electing to purchase preferred/non-preferred brand name drugs (Tier 2 and 3) when a generic equivalent is available will be required to pay the

difference between the cost of the generic and preferred/non-preferred brand name drug, plus the preferred brand copayment amount.

THIS IS ONLY A BRIEF SUMMARY Please reference your policy/SBC’s or contact insurance carrier for specific

4 benefit details and limitations.