Page 27 - ABC Company 2018 Open Enrollment Guide

P. 27

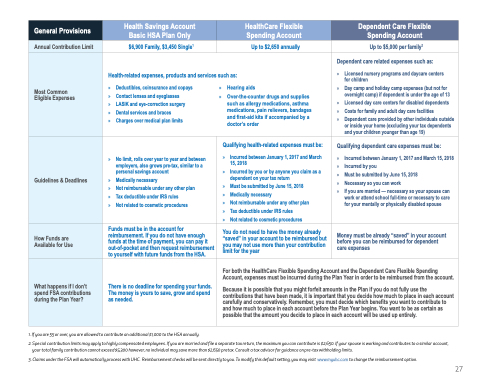

General Provisions

Health Savings Account Basic HSA Plan Only

HealthCare Flexible Spending Account

Dependent Care Flexible Spending Account

Annual Contribution Limit

$6,900 Family, $3,450 Single1

Up to $2,650 annually

Up to $5,000 per family2

Most Common Eligible Expenses

Health-related expenses, products and services such as:

» Deductibles, coinsurance and copays

» Contact lenses and eyeglasses

» LASIK and eye-correction surgery

» Dental services and braces

» Charges over medical plan limits

» Hearing aids

» Over-the-counter drugs and supplies such as allergy medications, asthma medications, pain relievers, bandages and first-aid kits if accompanied by a doctor’s order

Dependent care related expenses such as:

» Licensed nursery programs and daycare centers for children

» Day camp and holiday camp expenses (but not for overnight camp) if dependent is under the age of 13

» Licensed day care centers for disabled dependents

» Costs for family and adult day care facilities

» Dependent care provided by other individuals outside or inside your home (excluding your tax dependents and your children younger than age 19)

Guidelines & Deadlines

» No limit, rolls over year to year and between employers, also grows pre-tax, similar to a personal savings account

» Medically necessary

» Not reimbursable under any other plan

» Tax deductible under IRS rules

» Not related to cosmetic procedures

Qualifying health-related expenses must be:

» Incurred between January 1, 2017 and March 15, 2018

» Incurred by you or by anyone you claim as a dependent on your tax return

» Must be submitted by June 15, 2018

» Medically necessary

» Not reimbursable under any other plan

» Tax deductible under IRS rules

» Not related to cosmetic procedures

Qualifying dependent care expenses must be:

» Incurred between January 1, 2017 and March 15, 2018

» Incurred by you

» Must be submitted by June 15, 2018

» Necessary so you can work

» If you are married — necessary so your spouse can work or attend school full-time or necessary to care for your mentally or physically disabled spouse

How Funds are Available for Use

Funds must be in the account for reimbursement. If you do not have enough funds at the time of payment, you can pay it out-of-pocket and then request reimbursement to yourself with future funds from the HSA.

You do not need to have the money already “saved” in your account to be reimbursed but you may not use more than your contribution limit for the year

Money must be already “saved” in your account before you can be reimbursed for dependent care expenses

What happens if I don’t spend FSA contributions during the Plan Year?

There is no deadline for spending your funds. The money is yours to save, grow and spend as needed.

For both the HealthCare Flexible Spending Account and the Dependent Care Flexible Spending Account, expenses must be incurred during the Plan Year in order to be reimbursed from the account.

Because it is possible that you might forfeit amounts in the Plan if you do not fully use the contributions that have been made, it is important that you decide how much to place in each account carefully and conservatively. Remember, you must decide which benefits you want to contribute to and how much to place in each account before the Plan Year begins. You want to be as certain as possible that the amount you decide to place in each account will be used up entirely.

1. If you are 55 or over, you are allowed to contribute an additional $1,000 to the HSA annually.

2. Special contribution limits may apply to highly compensated employees. If you are married and file a separate tax return, the maximum you can contribute is $2,650. If your spouse is working and contributes to a similar account, your total family contribution cannot exceed $5,300 however, no individual may save more than $2,650 pretax. Consult a tax advisor for guidance on pre-tax withholding limits.

3. Claims under the FSA will automatically process with UHC. Reimbursement checks will be sent directly to you. To modify this default setting, you may visit www.myuhc.com to change the reimbursement option.

27