Page 6 - IMR652_GROUP5_EMAGAZINE

P. 6

1 The Findings The results showed positive means ranging Survey respondents were asked to reveal

their chosen method of record keeping. The

from 3.50 to 3.99, reflecting the overall

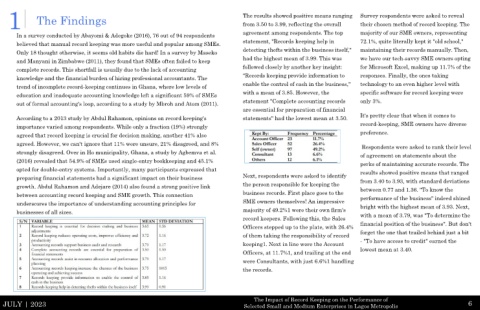

In a survey conducted by Abayomi & Adegoke (2016), 76 out of 94 respondents agreement among respondents. The top majority of our SME owners, representing

believed that manual record keeping was more useful and popular among SMEs. statement, "Records keeping help in 72.1%, quite literally kept it "old school,"

Only 18 thought otherwise, it seems old habits die hard! In a survey by Maseko detecting thefts within the business itself," maintaining their records manually. Then,

and Manyani in Zimbabwe (2011), they found that SMEs often failed to keep had the highest mean of 3.99. This was we have our tech-savvy SME owners opting

complete records. This shortfall is usually due to the lack of accounting followed closely by another key insight: for Microsoft Excel, making up 11.7% of the

knowledge and the financial burden of hiring professional accountants. The "Records keeping provide information to responses. Finally, the ones taking

trend of incomplete record-keeping continues in Ghana, where low levels of enable the control of cash in the business," technology to an even higher level with

education and inadequate accounting knowledge left a significant 59% of SMEs with a mean of 3.85. However, the specific software for record keeping were

out of formal accounting's loop, according to a study by Mbroh and Atom (2011). statement "Complete accounting records only 3%.

are essential for preparation of financial

According to a 2013 study by Abdul Rahamon, opinions on record keeping's statements" had the lowest mean at 3.50. It's pretty clear that when it comes to

importance varied among respondents. While only a fraction (19%) strongly record-keeping, SME owners have diverse

agreed that record keeping is crucial for decision making, another 41% also preference.

agreed. However, we can't ignore that 11% were unsure, 21% disagreed, and 8%

Respondents were asked to rank their level

strongly disagreed. Over in Ho municipality, Ghana, a study by Agbemva et al. of agreement on statements about the

(2016) revealed that 54.9% of SMEs used single-entry bookkeeping and 45.1% perks of maintaining accurate records. The

opted for double-entry systems. Importantly, many participants expressed that results showed positive means that ranged

preparing financial statements had a significant impact on their business Next, respondents were asked to identify from 3.40 to 3.93, with standard deviations

growth. Abdul Rahamon and Adejare (2014) also found a strong positive link the person responsible for keeping the between 0.77 and 1.36. "To know the

between accounting record keeping and SME growth. This connection business records. First place goes to the performance of the business" indeed shined

underscores the importance of understanding accounting principles for SME owners themselves! An impressive bright with the highest mean of 3.93. Next,

businesses of all sizes. majority of 49.2%1 were their own firm's with a mean of 3.79, was "To determine the

record keepers. Following this, the Sales

Officers stepped up to the plate, with 26.4% financial position of the business". But don't

of them taking the responsibility of record forget the one that trailed behind just a bit

keeping1. Next in line were the Account - "To have access to credit" earned the

lowest mean at 3.40.

Officers, at 11.7%1, and trailing at the end

were Consultants, with just 6.6%1 handling

the records.

The Impact of Record Keeping on the Performance of

JULY | 2023 Selected Small and Medium Enterprises in Lagos Metropolis 6