Page 42 - 2020 McLennan County Benefits Enrollment Guide

P. 42

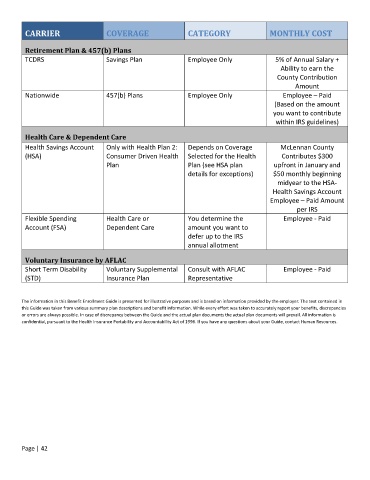

CARRIER COVERAGE CATEGORY MONTHLY COST

Retirement Plan & 457(b) Plans

TCDRS Savings Plan Employee Only 5% of Annual Salary +

Ability to earn the

County Contribution

Amount

Nationwide 457(b) Plans Employee Only Employee – Paid

(Based on the amount

you want to contribute

within IRS guidelines)

Health Care & Dependent Care

Health Savings Account Only with Health Plan 2: Depends on Coverage McLennan County

(HSA) Consumer Driven Health Selected for the Health Contributes $300

Plan Plan (see HSA plan upfront in January and

details for exceptions) $50 monthly beginning

midyear to the HSA-

Health Savings Account

Employee – Paid Amount

per IRS

Flexible Spending Health Care or You determine the Employee - Paid

Account (FSA) Dependent Care amount you want to

defer up to the IRS

annual allotment

Voluntary Insurance by AFLAC

Short Term Disability Voluntary Supplemental Consult with AFLAC Employee - Paid

(STD) Insurance Plan Representative

The information in this Benefit Enrollment Guide is presented for illustrative purposes and is based on information provided by the employer. The text contained in

this Guide was taken from various summary plan descriptions and benefit information. While every effort was taken to accurately report your benefits, discrepancies

or errors are always possible. In case of discrepancy between the Guide and the actual plan documents the actual plan documents will prevail. All information is

confidential, pursuant to the Health Insurance Portability and Accountability Act of 1996. If you have any questions about your Guide, contact Human Resources.

Page | 42