Page 11 - F:\01-PERSONAL CLIENTS\C\CVD\STAFF INDVIDUAL INCOME TAX\3-chandra mouli\MOULI\

P. 11

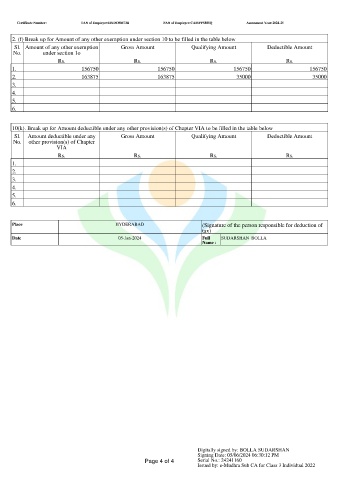

Certificate Number: TAN of Employer:HYDC00673B PAN of Employee:CAMPP5885Q Assessment Year:2024-25

2. (f) Break up for Amount of any other exemption under section 10 to be filled in the table below

Sl. Amount of any other exemption Gross Amount Qualifying Amount Deductible Amount

No. under section 1o

Rs. Rs. Rs. Rs.

1. 156750 156750 156750 156750

2. 163875 163875 35000 35000

3.

4.

5.

6.

10(k). Break up for Amount deductible under any other provision(s) of Chapter VIA to be filled in the table below

Sl. Amount deductible under any Gross Amount Qualifying Amount Deductible Amount

No. other provision(s) of Chapter

VIA

Rs. Rs. Rs. Rs.

1.

2.

3.

4.

5.

6.

Place HYDERABAD (Signature of the person responsible for deduction of

tax)

Date 05-Jun-2024 Full SUDARSHAN BOLLA

Name :

Digitally signed by: BOLLA SUDARSHAN

Signing Date: 05/06/2024 06:30:12 PM

Page 4 of 4 Serial No.: 24241160

Issued by: e-Mudhra Sub CA for Class 3 Individual 2022