Page 6 - F:\01-PERSONAL CLIENTS\C\CVD\STAFF INDVIDUAL INCOME TAX\3-chandra mouli\MOULI\

P. 6

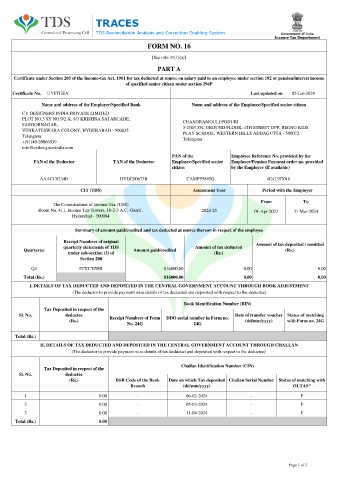

FORM NO. 16

[See rule 31(1)(a)]

PART A

Certificate under Section 203 of the Income-tax Act, 1961 for tax deducted at source on salary paid to an employee under section 192 or pension/interest income

of specified senior citizen under section 194P

Certificate No. UYFTHEA Last updated on 02-Jun-2024

Name and address of the Employer/Specified Bank Name and address of the Employee/Specified senior citizen

CV DESIGNERS INDIA PRIVATE LIMITED

PLOT NO.3 SY NO.9/2 &, 9/3 KRISHNA SAI ARCADE,

CHANDRAMOULI PODURI

SAROORNAGAR,

3-210/135C GROUND FLOOR, 4TH STREET OPP, RISING KIDS

VENKATESWARA COLONY, HYDERABAD - 500035

PLAY SCHOOL, WESTERN HILLS ADDAGUTTA - 500072

Telangana

Telangana

+(91)40-20066539

info@cvdesignersindia.com

PAN of the Employee Reference No. provided by the

PAN of the Deductor TAN of the Deductor Employee/Specified senior Employer/Pension Payment order no. provided

citizen by the Employer (If available)

AAACC8234B HYDC00673B CAMPP5885Q 4E41357018

CIT (TDS) Assessment Year Period with the Employer

From To

The Commissioner of Income Tax (TDS)

Room No. 411, Income Tax Towers, 10-2-3 A.C. Guard , 2024-25 01-Apr-2023 31-Mar-2024

Hyderabad - 500004

Summary of amount paid/credited and tax deducted at source thereon in respect of the employee

Receipt Numbers of original

Amount of tax deposited / remitted

quarterly statements of TDS Amount of tax deducted

Quarter(s) Amount paid/credited (Rs.)

under sub-section (3) of (Rs.)

Section 200

Q4 FFXCTZHR 816000.00 0.00 0.00

Total (Rs.) 816000.00 0.00 0.00

I. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH BOOK ADJUSTMENT

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Book Identification Number (BIN)

Tax Deposited in respect of the

Sl. No. deductee Date of transfer voucher Status of matching

Receipt Numbers of Form DDO serial number in Form no.

(Rs.) (dd/mm/yyyy) with Form no. 24G

No. 24G 24G

Total (Rs.)

II. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Challan Identification Number (CIN)

Tax Deposited in respect of the

Sl. No. deductee

(Rs.) BSR Code of the Bank Date on which Tax deposited Challan Serial Number Status of matching with

Branch (dd/mm/yyyy) OLTAS*

1 0.00 - 06-02-2024 - F

2 0.00 - 05-03-2024 - F

3 0.00 - 11-04-2024 - F

Total (Rs.) 0.00

Page 1 of 2