Page 3 - F:\01-PERSONAL CLIENTS\C\CVD\STAFF INDVIDUAL INCOME TAX\3-chandra mouli\MOULI\

P. 3

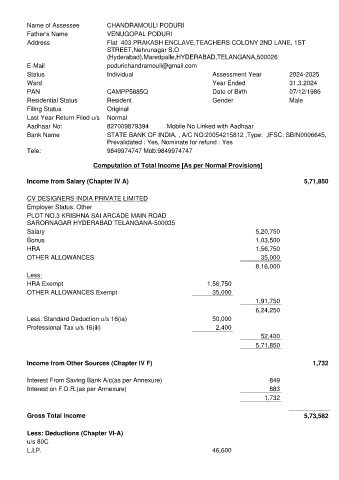

Name of Assessee CHANDRAMOULI PODURI

Father's Name VENUGOPAL PODURI

Address Flat 403 PRAKASH ENCLAVE,TEACHERS COLONY 2ND LANE, 1ST

STREET,Nehrunagar S.O

(Hyderabad),Maredpalle,HYDERABAD,TELANGANA,500026

E-Mail podurichandramouli@gmail.com

Status Individual Assessment Year 2024-2025

Ward Year Ended 31.3.2024

PAN CAMPP5885Q Date of Birth 07/12/1986

Residential Status Resident Gender Male

Filing Status Original

Last Year Return Filed u/s Normal

Aadhaar No: 827009879394 Mobile No Linked with Aadhaar

Bank Name STATE BANK OF INDIA, , A/C NO:20054215812 ,Type: ,IFSC: SBIN0006645,

Prevalidated : Yes, Nominate for refund : Yes

Tele: 9849974747 Mob:9849974747

Computation of Total Income [As per Normal Provisions]

Income from Salary (Chapter IV A) 5,71,850

CV DESIGNERS INDIA PRIVATE LIMITED

Employer Status: Other

PLOT NO.3 KRISHNA SAI ARCADE MAIN ROAD

SARORNAGAR HYDERABAD TELANGANA-500035

Salary 5,20,750

Bonus 1,03,500

HRA 1,56,750

OTHER ALLOWANCES 35,000

8,16,000

Less:

HRA Exempt 1,56,750

OTHER ALLOWANCES Exempt 35,000

1,91,750

6,24,250

Less: Standard Deduction u/s 16(ia) 50,000

Professional Tax u/s 16(iii) 2,400

52,400

5,71,850

Income from Other Sources (Chapter IV F) 1,732

Interest From Saving Bank A/c(as per Annexure) 849

Interest on F.D.R.(as per Annexure) 883

1,732

Gross Total Income 5,73,582

Less: Deductions (Chapter VI-A)

u/s 80C

L.I.P. 46,600