Page 4 - F:\01-PERSONAL CLIENTS\C\CVD\STAFF INDVIDUAL INCOME TAX\3-chandra mouli\MOULI\

P. 4

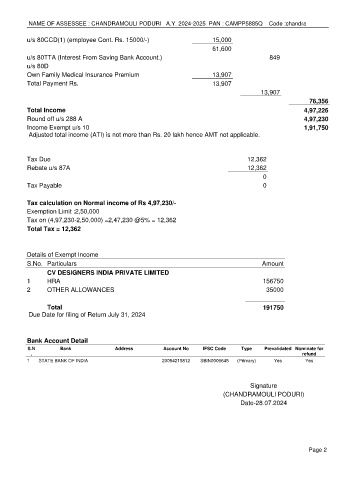

NAME OF ASSESSEE : CHANDRAMOULI PODURI A.Y. 2024-2025 PAN : CAMPP5885Q Code :chandra

u/s 80CCD(1) (employee Cont. Rs. 15000/-) 15,000

61,600

u/s 80TTA (Interest From Saving Bank Account.) 849

u/s 80D

Own Family Medical Insurance Premium 13,907

Total Payment Rs. 13,907

13,907

76,356

Total Income 4,97,226

Round off u/s 288 A 4,97,230

Income Exempt u/s 10 1,91,750

Adjusted total income (ATI) is not more than Rs. 20 lakh hence AMT not applicable.

Tax Due 12,362

Rebate u/s 87A 12,362

0

Tax Payable 0

Tax calculation on Normal income of Rs 4,97,230/-

Exemption Limit :2,50,000

Tax on (4,97,230-2,50,000) =2,47,230 @5% = 12,362

Total Tax = 12,362

Details of Exempt Income

S.No. Particulars Amount

CV DESIGNERS INDIA PRIVATE LIMITED

1 HRA 156750

2 OTHER ALLOWANCES 35000

Total 191750

Due Date for filing of Return July 31, 2024

Bank Account Detail

S.N Bank Address Account No IFSC Code Type Prevalidated Nominate for

. refund

1 STATE BANK OF INDIA 20054215812 SBIN0006645 (Primary) Yes Yes

Signature

(CHANDRAMOULI PODURI)

Date-28.07.2024

Page 2