Page 33 - 2020 Benefit

P. 33

A Guide to Your Health and Wellness Benefits | 2020

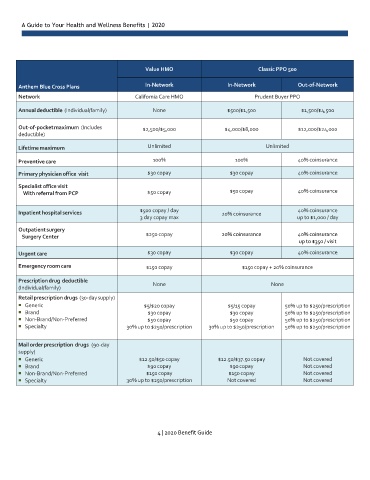

Value HMO Classic PPO 500

Anthem Blue Cross Plans In-Network In-Network Out-of-Network

Network California Care HMO Prudent Buyer PPO

Annual deductible (Individual/family) None $500/$1,500 $1,500/$4,500

Out-of-pocket maximum (Includes $2,500/$5,000 $4,000/$8,000 $12,000/$24,000

deductible)

Lifetime maximum Unlimited Unlimited

Preventive care 100% 100% 40% coinsurance

Primary physician office visit $30 copay $30 copay 40% coinsurance

Specialist office visit

With referral from PCP $50 copay $50 copay 40% coinsurance

$500 copay / day 40% coinsurance

Inpatient hospital services 20% coinsurance

3 day copay max up to $1,000 / day

Outpatient surgery

Surgery Center $250 copay 20% coinsurance 40% coinsurance

up to $350 / visit

Urgent care $30 copay $30 copay 40% coinsurance

Emergency room care $150 copay $150 copay + 20% coinsurance

Prescription drug deductible

None None

(Individual/family)

Retail prescription drugs (30-day supply)

Generic $5/$20 copay $5/15 copay 50% up to $250/prescription

Brand $30 copay $30 copay 50% up to $250/prescription

Non-Brand/Non-Preferred $50 copay $50 copay 50% up to $250/prescription

Specialty 30% up to $250/prescription 30% up to $250/prescription 50% up to $250/prescription

Mail order prescription drugs (90-day

supply)

Generic $12.50/$50 copay $12.50/$37.50 copay Not covered

Brand $90 copay $90 copay Not covered

Non-Brand/Non-Preferred $150 copay $150 copay Not covered

Specialty 30% up to $250/prescription Not covered Not covered

4 | 2020 Benefit Guide