Page 119 - FBL AR 2019-20

P. 119

CORPORATE STATUTORY FINANCIAL

OVERVIEW STATEMENTS STATEMENTS

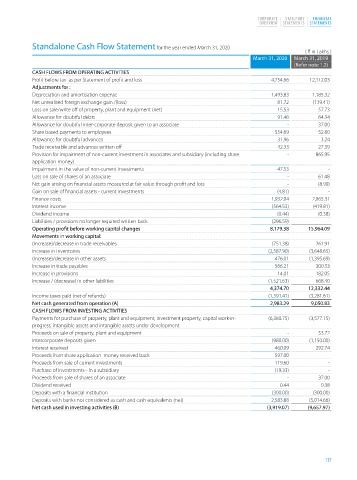

Standalone Cash Flow Statement for the year ended March 31, 2020

( H in Lakhs )

March 31, 2020 March 31, 2019

(Refer note 1.2)

CASH FLOWS FROM OPERATING ACTIVITIES

Profit before tax as per Statement of profit and loss 4,754.66 12,112.03

Adjustments for :

Depreciation and amortisation expense 1,493.83 1,185.32

Net unrealised foreign exchange gain /(loss) 81.72 (139.41)

Loss on sale/write off of property, plant and equipment (net) 15.53 57.73

Allowance for doubtful debts 91.46 64.34

Allowance for doubtful inter-corporate deposit given to an associate - 37.00

Share based payments to employees 554.69 52.80

Allowance for doubtful advances 31.96 3.24

Trade receivable and advances written off 42.33 27.39

Provision for impairment of non-current investment in associates and subsidiary (including share - 865.95

application money)

Impairment in the value of non-current investments 47.53 -

Loss on sale of shares of an associate - 61.48

Net gain arising on financial assets measured at fair value through profit and loss - (8.90)

Gain on sale of financial assets - current investments (4.81) -

Finance costs 1,932.04 2,065.31

Interest income (564.53) (419.81)

Dividend income (0.44) (0.38)

Liabilities / provisions no longer required written back (296.59) -

Operating profit before working capital changes 8,179.38 15,964.09

Movements in working capital:

(Increase)/decrease in trade receivables (751.38) 261.91

Increase in inventories (2,587.90) (3,648.65)

(Increase)/decrease in other assets 476.01 (1,395.69)

Increase in trade payables 566.21 300.33

Increase in provisions 14.01 182.05

Increase / (decrease) in other liabilities (1,521.63) 668.40

4,374.70 12,332.44

Income taxes paid (net of refunds) (1,391.41) (3,281.61)

Net cash generated from operation (A) 2,983.29 9,050.83

CASH FLOWS FROM INVESTING ACTIVITIES

Payments for purchase of property, plant and equipment, investment property, capital work-in- (6,380.75) (3,577.15)

progress, intangible assets and intangible assets under development

Proceeds on sale of property, plant and equipment - 53.72

Intercorporate deposits given (980.00) (1,150.00)

Interest received 460.09 292.74

Proceeds from share application money received back 597.00 -

Proceeds from sale of current investments 119.60 -

Purchase of investments - In a subsidiary (19.33) -

Proceeds from sale of shares of an associate - 37.00

Dividend received 0.44 0.38

Deposits with a financial institution (300.00) (300.00)

Deposits with banks not considered as cash and cash equivalents (net) 2,583.88 (5,014.66)

Net cash used in investing activities (B) (3,919.07) (9,657.97)

117