Page 126 - FBL AR 2019-20

P. 126

Fermenta Biotech Limited

Annual Report 2019-20

Notes to the Standalone financial statements for the year ended March 31, 2020

Transfers to, or from, investment property shall be made when, and only when, there is a change in use, evidenced by:

(a) commencement of owner-occupation, for a transfer from investment property to owner-occupied property

(b) commencement of development with a view to sale, for a transfer from investment property to inventories

(c) end of owner-occupation, for a transfer from owner-occupied property to investment property;

(d) commencement of an operating lease to another party, for a transfer from inventories to investment property

An investment property is derecognised upon disposal or when the investment property is permanently withdrawn from use and no

future economic benefits are expected from the disposal. Any gain or loss arising on derecognition of the property (calculated as the

difference between the net disposal proceeds and the carrying amount of the asset) is included in profit or loss in the period in which

the property is derecognised.

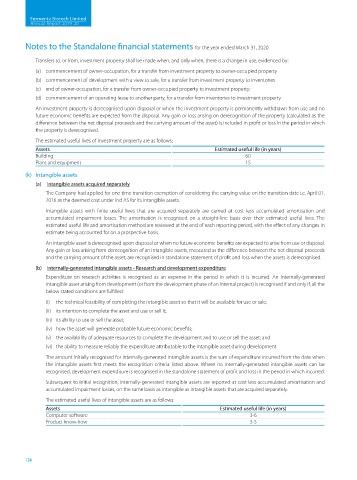

The estimated useful lives of Investment property are as follows:

Assets Estimated useful life (in years)

Building 60

Plant and equipment 15

(k) Intangible assets

(a) Intangible assets acquired separately

The Company had applied for one time transition exemption of considering the carrying value on the transition date i.e. April 01,

2016 as the deemed cost under Ind AS for its intangible assets.

Intangible assets with finite useful lives that are acquired separately are carried at cost less accumulated amortisation and

accumulated impairment losses. The amortisation is recognised on a straight-line basis over their estimated useful lives. The

estimated useful life and amortisation method are reviewed at the end of each reporting period, with the effect of any changes in

estimate being accounted for on a prospective basis.

An intangible asset is derecognised upon disposal or when no future economic benefits are expected to arise from use or disposal.

Any gain or loss arising from derecognition of an intangible assets, measured as the difference between the net disposal proceeds

and the carrying amount of the asset, are recognised in standalone statement of profit and loss when the assets is derecognised.

(b) Internally-generated intangible assets - Research and development expenditure

Expenditure on research activities is recognised as an expense in the period in which it is incurred. An Internally-generated

intangible asset arising from development (or from the development phase of an internal project) is recognised if and only if, all the

below stated conditions are fulfilled:

(i) the technical feasibility of completing the intangible asset so that it will be available for use or sale;

(ii) its intention to complete the asset and use or sell it;

(iii) its ability to use or sell the asset;

(iv) how the asset will generate probable future economic benefits;

(v) the availability of adequate resources to complete the development and to use or sell the asset; and

(vi) the ability to measure reliably the expenditure attributable to the intangible asset during development.

The amount initially recognised for internally-generated intangible assets is the sum of expenditure incurred from the date when

the intangible assets first meets the recognition criteria listed above. Where no internally-generated intangible assets can be

recognised, development expenditure is recognised in the standalone statement of profit and loss in the period in which incurred.

Subsequent to initial recognition, internally-generated intangible assets are reported at cost less accumulated amortisation and

accumulated impairment losses, on the same basis as intangible as intangible assets that are acquired separately.

The estimated useful lives of intangible assets are as follows:

Assets Estimated useful life (in years)

Computer software 3-6

Product know-how 3-5

124