Page 137 - FBL AR 2019-20

P. 137

CORPORATE STATUTORY FINANCIAL

OVERVIEW STATEMENTS STATEMENTS

Notes to the Standalone financial statements for the year ended March 31, 2020

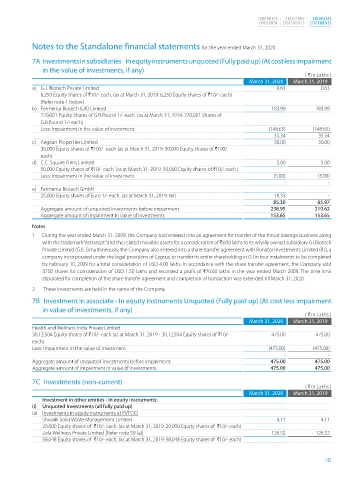

7A Investments in subsidiaries - in equity instruments unquoted (Fully paid up) (At cost less impairment

in the value of investments, if any)

( H in Lakhs )

March 31, 2020 March 31, 2019

a) G. I. Biotech Private Limited 0.63 0.63

6,250 Equity shares of H10/- each. (as at March 31, 2019: 6,250 Equity shares of H10/- each)

(Refer note 1 below)

b) Fermenta Biotech (UK) Limited 183.99 183.99

220,001 Equity Shares of G.B.Pound 1/- each. (as at March 31, 2019: 220,001 Shares of

G.B.Pound 1/- each)

Less: Impairment in the value of investment (148.65) (148.65)

35.34 35.34

c) Aegean Properties Limited 30.00 30.00

30,000 Equity shares of H100/- each (as at March 31, 2019: 30,000 Equity shares of H100/-

each)

d) C.C. Square Films Limited 5.00 5.00

50,000 Equity shares of H10/- each. (as at March 31, 2019: 50,000 Equity shares of H10/- each.)

Less: Impairment in the value of investment (5.00) (5.00)

- -

e) Fermenta Biotech GmbH

25,000 Equity shares of Euro 1/- each. (as at March 31, 2019: Nil) 19.33 -

85.30 65.97

Aggregate amount of unquoted investments before impairment 238.95 219.62

Aggregate amount of impairment in value of investments 153.65 153.65

Notes

1 During the year ended March 31, 2009, the Company had entered into an agreement for transfer of the throat lozenge business along

with the trademark “Astrasept” and the related movable assets for a consideration of H8.00 lakhs to its wholly owned subsidiary G.I.Biotech

Private Limited (G.I). Simultaneously, the Company also entered into a share transfer agreement with Ronator Investments Limited (R I), a

company incorporated under the legal provisions of Cyprus, to transfer its entire shareholding in G.I in four instalments to be completed

by February 10, 2009 for a total consideration of USD 4.00 lakhs. In accordance with the share transfer agreement, the Company sold

3750 shares for consideration of USD 1.50 lakhs and recorded a profit of H70.60 lakhs in the year ended March 2009. The time limit

stipulated for completion of the share transfer agreement and completion of transaction was extended till March 31, 2020.

2 These investments are held in the name of the Company.

7B Investment in associate - In equity instruments Unquoted (Fully paid up) (At cost less impairment

in value of investments, if any)

( H in Lakhs )

March 31, 2020 March 31, 2019

Health and Wellness India Private Limited

30,12,504 Equity shares of H10/- each (as at March 31, 2019 - 30,12,504 Equity shares of H10/- 475.00 475.00

each)

Less: Impairment in the value of investment (475.00) (475.00)

- -

Aggregate amount of unquoted investments before impairment. 475.00 475.00

Aggregate amount of impairment in value of investments. 475.00 475.00

7C Investments (non-current)

( H in Lakhs )

March 31, 2020 March 31, 2019

Investment in other entities - In equity instruments:

(i) Unquoted Investments (all fully paid up)

(a) Investments in equity instruments at FVTOCI

Shivalik Solid Waste Management Limited 4.11 4.11

20,000 Equity shares of H10/- each. (as at March 31, 2019: 20,000 Equity shares of H10/- each)

Zela Wellness Private Limited [Refer note 59 (a)] 126.52 126.52

58,048 Equity shares of H10/- each. (as at March 31, 2019: 58,048 Equity shares of H10/- each)

135