Page 142 - FBL AR 2019-20

P. 142

Fermenta Biotech Limited

Annual Report 2019-20

Notes to the Standalone financial statements for the year ended March 31, 2020

21 Equity share capital (contd.)

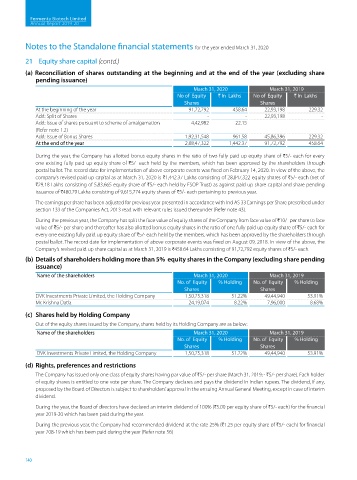

(a) Reconciliation of shares outstanding at the beginning and at the end of the year (excluding share

pending issuance)

March 31, 2020 March 31, 2019

No of Equity H In Lakhs No of Equity H In Lakhs

Shares Shares

At the beginning of the year 91,72,792 458.64 22,93,198 229.32

Add: Split of Shares - - 22,93,198 -

Add: Issue of shares pursuant to scheme of amalgamation 4,42,982 22.15 - -

(Refer note 1.2)

Add: Issue of Bonus Shares 1,92,31,548 961.58 45,86,396 229.32

At the end of the year 2,88,47,322 1,442.37 91,72,792 458.64

During the year, the Company has allotted bonus equity shares in the ratio of two fully paid up equity share of H5/- each for every

one existing fully paid up equity share of H5/- each held by the members, which has been approved by the shareholders through

postal ballot. The record date for implementation of above corporate events was fixed on February 14, 2020. In view of the above, the

company’s revised paid up capital as at March 31, 2020 is H1,442.37 Lakhs consisting of 28,847,322 equity shares of H5/- each (net of

H29.18 Lakhs consisting of 5,83,665 equity share of H5/- each held by ESOP Trust) as against paid up share capital and share pending

issuance of H480.79 Lakhs consisting of 9,615,774 equity shares of H5/- each pertaining to previous year.

The earnings per share has been adjusted for previous year presented in accordance with Ind AS 33 Earnings per Share prescribed under

section 133 of the Companies Act, 2013 read with relevant rules issued thereunder (Refer note 43).

During the previous year, the Company has split the face value of equity shares of the Company from face value of H10/- per share to face

value of H5/- per share and thereafter has also allotted bonus equity shares in the ratio of one fully paid up equity share of H5/- each for

every one existing fully paid up equity share of H5/- each held by the members, which has been approved by the shareholders through

postal ballot. The record date for implementation of above corporate events was fixed on August 09, 2018. In view of the above, the

Company’s revised paid up share capital as at March 31, 2019 is H458.64 Lakhs consisting of 91,72,792 equity shares of H5/- each.

(b) Details of shareholders holding more than 5% equity shares in the Company (excluding share pending

issuance)

Name of the shareholders March 31, 2020 March 31, 2019

No. of Equity % Holding No. of Equity % Holding

Shares Shares

DVK Investments Private Limited, the Holding Company 1,50,75,318 51.22% 49,44,940 53.91%

Mr. Krishna Datla 24,19,074 8.22% 7,96,000 8.68%

(c) Shares held by Holding Company

Out of the equity shares issued by the Company, shares held by its Holding Company are as below:

Name of the shareholders March 31, 2020 March 31, 2019

No. of Equity % Holding No. of Equity % Holding

Shares Shares

DVK Investments Private Limited, the Holding Company 1,50,75,318 51.22% 49,44,940 53.91%

(d) Rights, preferences and restrictions

The Company has issued only one class of equity shares having par value of H5/- per share (March 31, 2019; - H5/- per share). Each holder

of equity shares is entitled to one vote per share. The Company declares and pays the dividend in Indian rupees. The dividend, if any,

proposed by the Board of Directors is subject to shareholders’ approval in the ensuing Annual General Meeting, except in case of interim

dividend.

During the year, the Board of directors have declared an interim dividend of 100% (H5.00 per equity share of H5/- each) for the financial

year 2019-20 which has been paid during the year.

During the previous year, the Company had recommended dividend at the rate 25% (H1.25 per equity share of H5/- each) for financial

year 208-19 which has been paid during the year (Refer note 56)

140