Page 143 - FBL AR 2019-20

P. 143

CORPORATE STATUTORY FINANCIAL

OVERVIEW STATEMENTS STATEMENTS

Notes to the Standalone financial statements for the year ended March 31, 2020

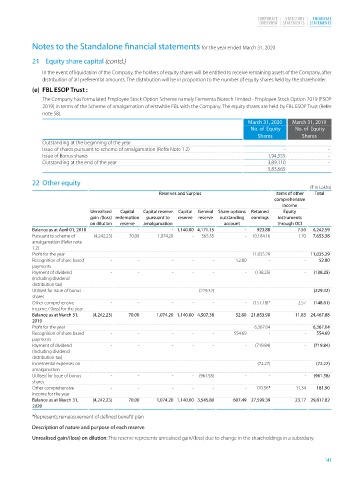

21 Equity share capital (contd.)

In the event of liquidation of the Company, the holders of equity shares will be entitled to receive remaining assets of the Company, after

distribution of all preferential amounts. The distribution will be in proportion to the number of equity shares held by the shareholder.

(e) FBL ESOP Trust :

The Company has formulated Employee Stock Option Scheme namely Fermenta Biotech Limited - Employee Stock Option 2019 (ESOP

2019) in terms of the Scheme of amalgamation of erstwhile FBL with the Company. The equity shares are held by FBL ESOP Trust (Refer

note 58).

March 31, 2020 March 31, 2019

No. of Equity No. of Equity

Shares Shares

Outstanding at the beginning of the year

Issue of shares pursuant to scheme of amalgamation (Refer Note 1.2) - -

Issue of Bonus shares 1,94,555 -

Outstanding at the end of the year 3,89,110 -

5,83,665 -

22 Other equity

(H in Lakhs)

Reserves and Surplus Items of other Total

comprehensive

income

Unrealised Capital Capital reserve Capital General Share options Retained Equity

gain /(loss) redemption pursuant to reserve reserve outstanding earnings instruments

on dilution reserve amalgamation account through OCI

Balance as at April 01, 2018 - - - 1,140.00 4,171.15 - 923.88 7.56 6,242.59

Pursuant to scheme of (4,242.23) 70.00 1,074.20 - 565.55 - 10,184.16 1.70 7,653.38

amalgamation (Refer note

1.2)

Profit for the year - - - - - - 11,035.29 - 11,035.29

Recognition of share based - - - - - 52.80 - - 52.80

payments

Payment of dividend - - - - - - (138.25) - (138.25)

(including dividend

distribution tax)

Utilised for issue of bonus - - - - (229.32) - - - (229.32)

shares

Other comprehensive - - - - - - (151.18)* 2.57 (148.61)

income / (loss) for the year

Balance as at March 31, (4,242.23) 70.00 1,074.20 1,140.00 4,507.38 52.80 21,853.90 11.83 24,467.88

2019

Profit for the year - - - - - - 6,367.04 - 6,367.04

Recognition of share based - - - - - 554.69 - - 554.69

payments

Payment of dividend - - - - - - (719.84) - (719.84)

(including dividend

distribution tax)

Incremental expenses on - - - - - - (72.27) - (72.27)

amalgamation

Utilised for issue of bonus - - - - (961.58) - - - (961.58)

shares

Other comprehensive - - - - - - 170.56* 11.34 181.90

income for the year

Balance as at March 31, (4,242.23) 70.00 1,074.20 1,140.00 3,545.80 607.49 27,599.39 23.17 29,817.82

2020

*Represents remeasurement of defined benefit plan

Description of nature and purpose of each reserve

Unrealised gain/(loss) on dilution: This reserve represents unrealised gain/(loss) due to change in the shareholdings in a subsidiary.

141