Page 144 - FBL AR 2019-20

P. 144

Fermenta Biotech Limited

Annual Report 2019-20

Notes to the Standalone financial statements for the year ended March 31, 2020

22 Other equity (contd.)

Capital redemption reserve: This reserve was created for redemption of preference shares of H70.00 lakhs in the financial year 2010-2011.

Capital reserve pursuant to amalgamation: This reserve created consequent to amalgamation of a subsidiary with the Company.

Capital reserve: Capital reserve was created in the financial years 1995-96 and 1996-97 pursuant to sale of the Company’s brands for which

non compete fees were received and treated as a capital receipt.

General reserve: This reserve arises on transfer portion of the net profit pursuant to earlier provision of the Companies Act, 1956. Mandatory

transfer to general reserve is not required under the Companies Act, 2013.

Share options outstanding account: The fair value of the equity settled share based payment transactions is recognised to share options

outstanding account.

Retained earnings: Profits generated by the Company that are not distributed to shareholders as dividends but are reinvested in the business.

Equity instruments through other comprehensive income: This represents the cumulative gains / losses arising on the revaluation of

equity instruments measured at fair value through other comprehensive income, under an irrevocable option, net of amounts reclassified to

retained earnings when such assets are disposed off.

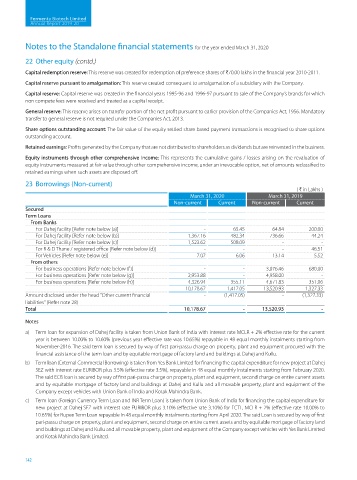

23 Borrowings (Non-current)

( H in Lakhs )

March 31, 2020 March 31, 2019

Non-current Current Non-current Current

Secured

Term Loans

From Banks

For Dahej facility [Refer note below (a)] - 65.45 64.84 200.00

For Dahej facility [Refer note below (b)] 1,367.16 482.34 736.66 44.24

For Dahej facility [Refer note below (c)] 1,523.62 508.09 - -

For R & D Thane / registered office [Refer note below (d)] - - - 46.51

For Vehicles [Refer note below (e)] 7.07 6.06 13.14 5.52

From others

For business operations [Refer note below (f)] - - 3,076.46 680.00

For business operations [Refer note below (g)] 2,953.88 - 4,958.00 -

For business operations [Refer note below (h)] 4,326.94 355.11 4,671.83 351.06

10,178.67 1,417.05 13,520.93 1,327.33

Amount disclosed under the head "Other current financial - (1,417.05) - (1,327.33)

liabilities" (Refer note 28)

Total 10,178.67 - 13,520.93 -

Notes

a) Term loan for expansion of Dahej facility is taken from Union Bank of India with interest rate MCLR + 2% effective rate for the current

year is between 10.00% to 10.60% (previous year effective rate was 10.65%) repayable in 48 equal monthly instalments starting from

November-2016. The said term loan is secured by way of first pari-passu charge on property, plant and equipment procured with the

financial assistance of the term loan and by equitable mortgage of factory land and buildings at Dahej and Kullu.

b) Term loan (External Commercial Borrowing) is taken from Yes Bank Limited for financing the capital expenditure for new project at Dahej

SEZ with interest rate EURIBOR plus 3.5% (effective rate 3.5%), repayable in 48 equal monthly instalments starting from February 2020.

The said ECB loan is secured by way of first pari-passu charge on property, plant and equipment, second charge on entire current assets

and by equitable mortgage of factory land and buildings at Dahej and Kullu and all movable property, plant and equipment of the

Company except vehicles with Union Bank of India and Kotak Mahindra Bank.

c) Term loan (Foreign Currency Term Loan and INR Term Loan) is taken from Union Bank of India for financing the capital expenditure for

new project at Dahej SEZ with interest rate EURIBOR plus 3.10% (effective rate 3.10%) for FCTL, MCLR + 2% (effective rate 10.00% to

10.65%) for Rupee Term Loan repayable in 48 equal monthly instalments starting from April 2020. The said Loan is secured by way of first

pari-passu charge on property, plant and equipment, second charge on entire current assets and by equitable mortgage of factory land

and buildings at Dahej and Kullu and all movable property, plant and equipment of the Company except vehicles with Yes Bank Limited

and Kotak Mahindra Bank Limited.

142