Page 154 - FBL AR 2019-20

P. 154

Fermenta Biotech Limited

Annual Report 2019-20

Notes to the Standalone financial statements for the year ended March 31, 2020

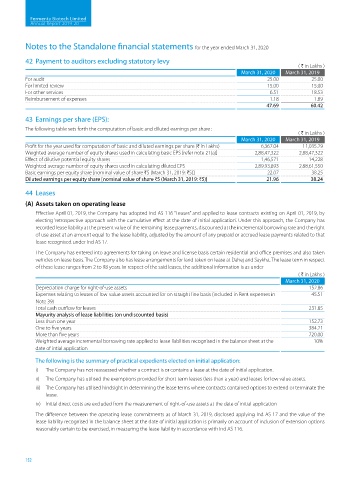

42 Payment to auditors excluding statutory levy

( H in Lakhs )

March 31, 2020 March 31, 2019

For audit 25.00 25.00

For limited review 15.00 15.00

For other services 6.51 18.53

Reimbursement of expenses 1.18 1.89

47.69 60.42

43 Earnings per share (EPS):

The following table sets forth the computation of basic and diluted earnings per share :

( H in Lakhs )

March 31, 2020 March 31, 2019

Profit for the year used for computation of basic and diluted earnings per share (H in Lakhs) 6,367.04 11,035.29

Weighted average number of equity shares used in calculating basic EPS [refer note 21(a)] 2,88,47,322 2,88,47,322

Effect of dilutive potential equity shares 1,46,571 14,228

Weighted average number of equity shares used in calculating diluted EPS 2,89,93,893 2,88,61,550

Basic earnings per equity share [nominal value of share H5 (March 31, 2019: H5)] 22.07 38.25

Diluted earnings per equity share [nominal value of share H5 (March 31, 2019: H5)] 21.96 38.24

44 Leases

(A) Assets taken on operating lease

Effective April 01, 2019, the Company has adopted Ind AS 116 “Leases” and applied to lease contracts existing on April 01, 2019, by

electing ‘retrospective approach with the cumulative effect at the date of initial application’. Under this approach, the Company has

recorded lease liability at the present value of the remaining lease payments, discounted at the incremental borrowing rate and the right

of use asset at an amount equal to the lease liability, adjusted by the amount of any prepaid or accrued lease payments related to that

lease recognised under Ind AS 17.

The Company has entered into agreements for taking on leave and license basis certain residential and office premises and also taken

vehicles on lease basis. The Company also has lease arrangements for land taken on lease at Dahej and Saykha. The lease term in respect

of these lease ranges from 2 to 98 years. In respect of the said leases, the additional information is as under

( H in Lakhs )

March 31, 2020

Depreciation charge for right-of-use assets 152.86

Expenses relating to leases of low-value assets accounted for on straight line basis (included in Rent expenses in 45.51

Note 39)

Total cash outflow for leases 231.85

Mayurity analysis of lease liabilities (on undiscounted basis)

Less than one year 152.73

One to five years 384.21

More than five years 720.00

Weighted average incremental borrowing rate applied to lease liabilities recognised in the balance sheet at the 10%

date of intial application

The following is the summary of practical expedients elected on initial application:

i) The Company has not reassessed whether a contract is or contains a lease at the date of initial application.

ii) The Company has utilised the exemptions provided for short-term leases (less than a year) and leases for low value assets.

iii) The Company has utilised hindsight in determining the lease terms where contracts contained options to extend or terminate the

lease.

iv) Initial direct costs are excluded from the measurement of right-of-use assets at the date of initial application

The difference between the operating lease commitments as of March 31, 2019, disclosed applying Ind AS 17 and the value of the

lease liability recognised in the balance sheet at the date of initial application is primarily on account of inclusion of extension options

reasonably certain to be exercised, in measuring the lease liability in accordance with Ind AS 116.

152