Page 159 - FBL AR 2019-20

P. 159

CORPORATE STATUTORY FINANCIAL

OVERVIEW STATEMENTS STATEMENTS

Notes to the Standalone financial statements for the year ended March 31, 2020

46 Income tax (contd.)

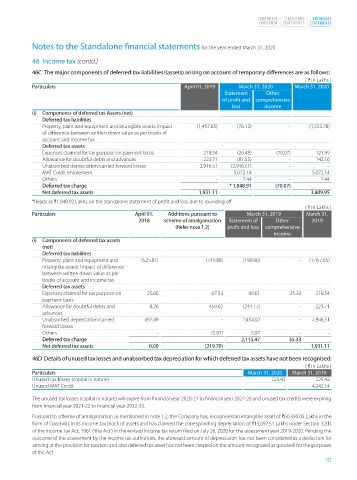

46C The major components of deferred tax liabilities/(assets) arising on account of temporary differences are as follows:

( H in Lakhs )

Particulars April 01, 2019 March 31, 2020 March 31, 2020

Statement Other

of profit and comprehensive

loss income

(i) Components of deferred tax Assets (net)

Deferred tax liabilities

Property, plant and equipment and intangible assets: Impact (1,457.65) (76.13) - (1,533.78)

of difference between written down value as per books of

account and income tax

Deferred tax assets

Expenses claimed for tax purpose on payment basis 218.54 (26.48) (70.07) 121.99

Allowance for doubtful debts and advances 223.71 (81.55) - 142.16

Unabsorbed depreciation/carried forward losses 2,946.51 (2,946.51) - -

MAT Credit entitlement - 5,072.14 - 5,072.14

Others - 7.44 - 7.44

Deferred tax charge * 1,948.91 (70.07)

Net deferred tax assets 1,931.11 3,809.95

*Reads as H1,948.92 Lakhs on the standalone statement of profit and loss due to rounding off

( H in Lakhs )

Particulars April 01, Additions pursuant to March 31, 2019 March 31,

2018 scheme of amalgamation Statement of Other 2019

(Refer note 1.2) profit and loss comprehensive

income

(i) Components of deferred tax assets

(net)

Deferred tax liabilities

Property, plant and equipment and (525.81) (740.88) (190.96) - (1,457.65)

intangible assets: Impact of difference

between written down value as per

books of account and income tax

Deferred tax assets

Expenses claimed for tax purpose on 25.06 67.53 90.61 35.33 218.54

payment basis

Allowance for doubtful debts and 8.26 459.62 (244.17) - 223.71

advances

Unabsorbed depreciation/carried 492.49 - 2,454.02 - 2,946.51

forward losses

Others - (5.97) 5.97 - -

Deferred tax charge 2,115.47 35.33

Net deferred tax assets 0.00 (219.70) 1,931.11

46D Details of unused tax losses and unabsorbed tax depreciation for which deferred tax assets have not been recognised:

( H in Lakhs )

Particulars March 31, 2020 March 31, 2019

Unused tax losses (capital in nature) 225.42 225.42

Unused MAT Credit - 4,242.14

The unused tax losses (capital in nature) will expire from financial year 2020-21 to financial year 2027-28 and unused tax credits were expiring

from financial year 2021-22 to financial year 2032-33.

Pursuant to scheme of amalgamation as mentioned in note 1.2, the Company has, recognised an intangible asset of H60,390.05 Lakhs in the

form of Goodwill, in its income tax block of assets and has claimed the corresponding depreciation of H15,097.51 Lakhs under Section 32(1)

of the Income Tax Act, 1961 (‘the Act’) in the revised income tax return filed on July 26, 2020 for the assessment year 2019-2020. Pending the

outcome of the assessment by the income tax authorities, the aforesaid amount of depreciation has not been considered as a deduction for

arriving at the provision for taxation and also deferred tax asset has not been created on the amount recognized as goodwill for the purposes

of the Act

157