Page 160 - FBL AR 2019-20

P. 160

Fermenta Biotech Limited

Annual Report 2019-20

Notes to the Standalone financial statements for the year ended March 31, 2020

47 Research and development expenditure

Research and development expenditure of H653.85 Lakhs (March 31, 2019: H879.10 Lakhs) (excluding interest and depreciation) has

been charged to the Standalone statement of profit and loss. The capital expenditure in the current year on research and development

amounts to H497.20 Lakhs (March 31, 2019: H115.16 Lakhs).

48 During the year ended March 31, 2020, Commission of H248.00 Lakhs to the Managing Director and Executive Directors and directors

sitting fees and commission to non-excecutive directors aggregating H73.34 Lakhs has been charged to the Standalone statement of

profit and loss. During the year ended March 31, 2019, Commission of H1,137.54 Lakhs to the Managing Director and Executive Director

of Erstwhile Fermenta Biotech Limited and Commission and directors sitting fees aggregating H169.98 Lakhs to the Non-Executive

directors has been charged to the Standalone statement of profit and loss.

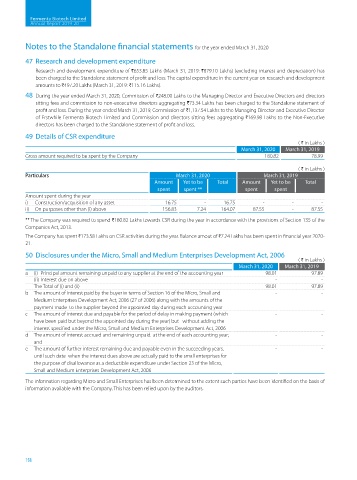

49 Details of CSR expenditure

( H in Lakhs )

March 31, 2020 March 31, 2019

Gross amount required to be spent by the Company 180.82 78.99

( H in Lakhs )

Particulars March 31, 2020 March 31, 2019

Amount Yet to be Total Amount Yet to be Total

spent spent ** spent spent

Amount spent during the year

i) Construction/acquisition of any asset 16.75 - 16.75 - - -

ii) On purposes other than (i) above 156.83 7.24 164.07 87.55 - 87.55

** The Company was required to spend H180.82 Lakhs towards CSR during the year in accordance with the provisions of Section 135 of the

Companies Act, 2013.

The Company has spent H173.58 Lakhs on CSR activities during the year. Balance amout of H7.24 Lakhs has been spent in financial year 2020-

21.

50 Disclosures under the Micro, Small and Medium Enterprises Development Act, 2006

( H in Lakhs )

March 31, 2020 March 31, 2019

a (i) Principal amount remaining unpaid to any supplier at the end of the accounting year 98.01 97.89

(ii) Interest due on above - -

The Total of (i) and (ii) 98.01 97.89

b The amount of interest paid by the buyer in terms of Section 16 of the Micro, Small and - -

Medium Enterprises Development Act, 2006 (27 of 2006) along with the amounts of the

payment made to the supplier beyond the appointed day during each accounting year

c The amount of interest due and payable for the period of delay in making payment (which - -

have been paid but beyond the appointed day during the year) but without adding the

interest specified under the Micro, Small and Medium Enterprises Development Act, 2006

d The amount of interest accrued and remaining unpaid at the end of each accounting year; - -

and

e The amount of further interest remaining due and payable even in the succeeding years, - -

until such date when the interest dues above are actually paid to the small enterprises for

the purpose of disallowance as a deductible expenditure under Section 23 of the Micro,

Small and Medium Enterprises Development Act, 2006

The information regarding Micro and Small Enterprises has been determined to the extent such parties have been identified on the basis of

information available with the Company. This has been relied upon by the auditors.

158