Page 216 - FBL AR 2019-20

P. 216

Fermenta Biotech Limited

Annual Report 2019-20

Notes to the Consolidated financial statements for the year ended March 31, 2020

42 Employee benefits (contd.)

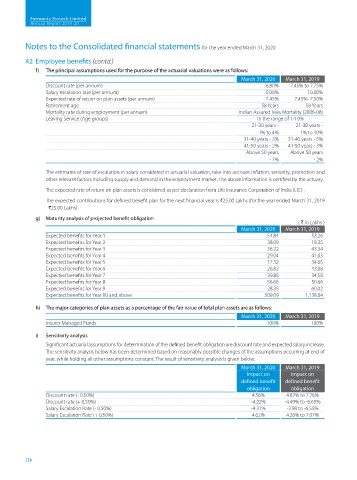

f) The principal assumptions used for the purpose of the actuarial valuations were as follows:

March 31, 2020 March 31, 2019

Discount rate (per annum) 6.80% 7.45% to 7.75%

Salary escalation rate (per annum) 5.00% 10.00%

Expected rate of return on plan assets (per annum) 7.45% 7.45%- 7.50%

Retirement age 58 Years 58 Years

Mortality rate during employment (per annum) Indian Assured lives Mortality (2006-08)

Leaving Service (Age groups) In the range of 1-10%

21-30 years - 21-30 years -

1% to 4% 1% to 10%

31-40 years - 3% 31-40 years - 5%

41-50 years - 2% 41-50 years - 3%

Above 50 years Above 50 years

- 1% - 2%

The estimates of rate of escalation in salary considered in actuarial valuation, take into account inflation, seniority, promotion and

other relevant factors including supply and demand in the employment market. The above information is certified by the actuary.

The expected rate of return on plan assets is considered as per declaration from Life Insurance Corporation of India (LIC) .

The expected contributions for defined benefit plan for the next financial year is H25.00 Lakhs (for the year ended March 31, 2019

- H25.00 Lakhs)

g) Maturity analysis of projected benefit obligation

( H in Lakhs )

March 31, 2020 March 31, 2019

Expected benefits for Year 1 54.84 53.26

Expected benefits for Year 2 38.09 18.35

Expected benefits for Year 3 36.22 43.34

Expected benefits for Year 4 29.04 41.03

Expected benefits for Year 5 17.32 34.65

Expected benefits for Year 6 26.82 43.08

Expected benefits for Year 7 39.88 34.58

Expected benefits for Year 8 56.66 50.66

Expected benefits for Year 9 28.35 60.02

Expected benefits for Year 10 and above 509.09 1,136.04

h) The major categories of plan assets as a percentage of the fair value of total plan assets are as follows:

March 31, 2020 March 31, 2019

Insurer Managed Funds 100% 100%

i) Sensitivity analysis

Significant actuarial assumptions for determination of the defined benefit obligation are discount rate and expected salary increase.

The sensitivity analysis below has been determined based on reasonably possible changes of the assumptions occurring at end of

year, while holding all other assumptions constant. The result of sensitivity analysis is given below:

March 31, 2020 March 31, 2019

Impact on Impact on

defined benefit defined benefit

obligation obligation

Discount rate (- 0.50%) 4.56% 4.87% to 7.26%

Discount rate (+ 0.50%) -4.22% -4.49% to -6.65%

Salary Escalation Rate (- 0.50%) -4.31% -3.98 to -6.55%

Salary Escalation Rate (+ 0.50%) 4.62% 4.26% to 7.07%

214