Page 211 - FBL AR 2019-20

P. 211

CORPORATE STATUTORY FINANCIAL

OVERVIEW STATEMENTS STATEMENTS

Notes to the Consolidated financial statements for the year ended March 31, 2020

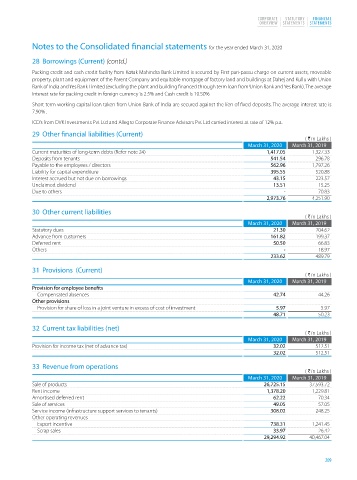

28 Borrowings (Current) (contd.)

Packing credit and cash credit facility from Kotak Mahindra Bank Limited is secured by First pari-passu charge on current assets, moveable

property, plant and equipment of the Parent Company and equitable mortgage of factory land and buildings at Dahej and Kullu with Union

Bank of India and Yes Bank Limited (excluding the plant and building financed through term loan from Union Bank and Yes Bank). The average

interest rate for packing credit in foreign currency is 2.5% and Cash credit is 10.50%

Short term working capital loan taken from Union Bank of India are secured against the lien of fixed deposits. The average interest rate is

7.90% .

ICD’s from DVK Investments Pvt Ltd and Allegro Corporate Finance Advisors Pvt Ltd carried interest at rate of 12% p.a.

29 Other financial liabilities (Current)

( H in Lakhs )

March 31, 2020 March 31, 2019

Current maturities of long-term debts (Refer note 24) 1,417.05 1,327.33

Deposits from tenants 541.54 296.78

Payable to the employees / directors 562.96 1,797.26

Liability for capital expenditure 395.55 520.88

Interest accrued but not due on borrowings 43.15 223.57

Unclaimed dividend 13.51 15.25

Due to others - 70.83

2,973.76 4,251.90

30 Other current liabilities

( H in Lakhs )

March 31, 2020 March 31, 2019

Statutory dues 21.30 204.62

Advance from customers 161.82 199.37

Deferred rent 50.50 66.83

Others - 18.97

233.62 489.79

31 Provisions (Current)

( H in Lakhs )

March 31, 2020 March 31, 2019

Provision for employee benefits

Compensated absences 42.74 44.26

Other provisions

Provision for share of loss in a joint venture in excess of cost of investment 5.97 5.97

48.71 50.23

32 Current tax liabilities (net)

( H in Lakhs )

March 31, 2020 March 31, 2019

Provision for income tax (net of advance tax) 32.02 512.51

32.02 512.51

33 Revenue from operations

( H in Lakhs )

March 31, 2020 March 31, 2019

Sale of products 26,725.15 37,593.72

Rent income 1,378.20 1,229.81

Amortised deferred rent 62.22 70.34

Sale of services 49.05 57.05

Service income (infrastructure support services to tenants) 308.02 248.25

Other operating revenues

Export incentive 738.31 1,241.45

Scrap sales 33.97 26.42

29,294.92 40,467.04

209