Page 207 - FBL AR 2019-20

P. 207

CORPORATE STATUTORY FINANCIAL

OVERVIEW STATEMENTS STATEMENTS

Notes to the Consolidated financial statements for the year ended March 31, 2020

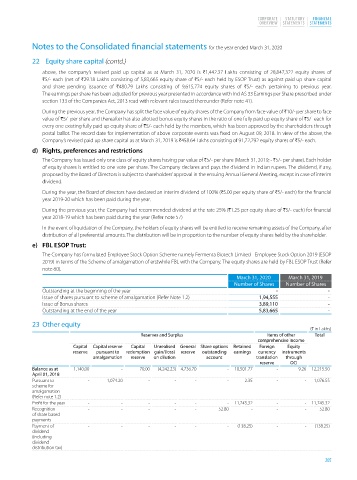

22 Equity share capital (contd.)

above, the company’s revised paid up capital as at March 31, 2020 is H1,442.37 Lakhs consisting of 28,847,322 equity shares of

H5/- each (net of H29.18 Lakhs consisting of 5,83,665 equity share of H5/- each held by ESOP Trust) as against paid up share capital

and share pending issuance of H480.79 Lakhs consisting of 9,615,774 equity shares of H5/- each pertaining to previous year.

The earnings per share has been adjusted for previous year presented in accordance with Ind AS 33 Earnings per Share prescribed under

section 133 of the Companies Act, 2013 read with relevant rules issued thereunder (Refer note 41).

During the previous year, the Company has split the face value of equity shares of the Company from face value of H10/- per share to face

value of H5/- per share and thereafter has also allotted bonus equity shares in the ratio of one fully paid up equity share of H5/- each for

every one existing fully paid up equity share of H5/- each held by the members, which has been approved by the shareholders through

postal ballot. The record date for implementation of above corporate events was fixed on August 09, 2018. In view of the above, the

Company’s revised paid up share capital as at March 31, 2019 is H458.64 Lakhs consisting of 91,72,792 equity shares of H5/- each.

d) Rights, preferences and restrictions

The Company has issued only one class of equity shares having par value of H5/- per share (March 31, 2019; - H5/- per share). Each holder

of equity shares is entitled to one vote per share. The Company declares and pays the dividend in Indian rupees. The dividend, if any,

proposed by the Board of Directors is subject to shareholders’ approval in the ensuing Annual General Meeting, except in case of interim

dividend.

During the year, the Board of directors have declared an interim dividend of 100% (H5.00 per equity share of H5/- each) for the financial

year 2019-20 which has been paid during the year.

During the previous year, the Company had recommended dividend at the rate 25% (H1.25 per equity share of H5/- each) for financial

year 2018-19 which has been paid during the year (Refer note 57)

In the event of liquidation of the Company, the holders of equity shares will be entitled to receive remaining assets of the Company, after

distribution of all preferential amounts. The distribution will be in proportion to the number of equity shares held by the shareholder.

e) FBL ESOP Trust:

The Company has formulated Employee Stock Option Scheme namely Fermenta Biotech Limited - Employee Stock Option 2019 (ESOP

2019) in terms of the Scheme of amalgamation of erstwhile FBL with the Company. The equity shares are held by FBL ESOP Trust (Refer

note 60).

March 31, 2020 March 31, 2019

Number of Shares Number of Shares

Outstanding at the beginning of the year - -

Issue of shares pursuant to scheme of amalgamation (Refer Note 1.2) 1,94,555 -

Issue of Bonus shares 3,89,110 -

Outstanding at the end of the year 5,83,665 -

23 Other equity

(H in Lakhs)

Reserves and Surplus Items of other Total

comprehensive income

Capital Capital reserve Capital Unrealised General Share options Retained Foreign Equity

reserve pursuant to redemption gain/(loss) reserve outstanding earnings currency instruments

amalgamation reserve on dilution account translation through

reserve OCI

Balance as at 1,140.00 - 70.00 (4,242.23) 4,736.70 - 10,501.77 - 9.26 12,215.50

April 01, 2018

Pursuant to - 1,074.20 - - - - 2.35 - - 1,076.55

scheme for

amalgamation

(Refer note 1.2)

Profit for the year - - - - - - 11,745.32 - - 11,745.32

Recognition - - - - - 52.80 - - - 52.80

of share based

payments

Payment of - - - - - - (138.25) - - (138.25)

dividend

(including

dividend

distribution tax)

205