Page 208 - FBL AR 2019-20

P. 208

Fermenta Biotech Limited

Annual Report 2019-20

Notes to the Consolidated financial statements for the year ended March 31, 2020

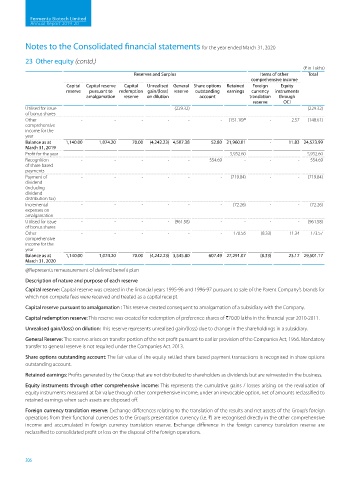

23 Other equity (contd.)

(H in Lakhs)

Reserves and Surplus Items of other Total

comprehensive income

Capital Capital reserve Capital Unrealised General Share options Retained Foreign Equity

reserve pursuant to redemption gain/(loss) reserve outstanding earnings currency instruments

amalgamation reserve on dilution account translation through

reserve OCI

Utilised for issue - - - - (229.32) - - - - (229.32)

of bonus shares

Other - - - - - - (151.18) @ - 2.57 (148.61)

comprehensive

income for the

year

Balance as at 1,140.00 1,074.20 70.00 (4,242.23) 4,507.38 52.80 21,960.01 - 11.83 24,573.99

March 31, 2019

Profit for the year - - - - - - 5,952.60 - - 5,952.60

Recognition - - - - - 554.69 - - - 554.69

of share based

payments

Payment of - - - - - - (719.84) - - (719.84)

dividend

(including

dividend

distribution tax)

Incremental - - - - - - (72.26) - - (72.26)

expenses on

amalgamation

Utilised for issue - - - - (961.58) - - - - (961.58)

of bonus shares

Other - - - - - - 170.56 (8.33) 11.34 173.57

comprehensive

income for the

year

Balance as at 1,140.00 1,074.20 70.00 (4,242.23) 3,545.80 607.49 27,291.07 (8.33) 23.17 29,501.17

March 31, 2020

@Represents remeasurement of defined benefit plan

Description of nature and purpose of each reserve

Capital reserve: Capital reserve was created in the financial years 1995-96 and 1996-97 pursuant to sale of the Parent Company’s brands for

which non compete fees were received and treated as a capital receipt.

Capital reserve pursuant to amalgamation : This reserve created consequent to amalgamation of a subsidiary with the Company.

Capital redemption reserve: This reserve was created for redemption of preference shares of H70.00 lakhs in the financial year 2010-2011.

Unrealised gain/(loss) on dilution: This reserve represents unrealised gain/(loss) due to change in the shareholdings in a subsidiary.

General Reserve: The reserve arises on transfer portion of the net profit pursuant to earlier provision of the Companies Act, 1956. Mandatory

transfer to general reserve is not required under the Companies Act. 2013.

Share options outstanding account: The fair value of the equity settled share based payment transactions is recognised in share options

outstanding account.

Retained earnings: Profits generated by the Group that are not distributed to shareholders as dividends but are reinvested in the business.

Equity instruments through other comprehensive income: This represents the cumulative gains / losses arising on the revaluation of

equity instruments measured at fair value through other comprehensive income, under an irrevocable option, net of amounts reclassified to

retained earnings when such assets are disposed off.

Foreign currency translation reserve: Exchange differences relating to the translation of the results and net assets of the Group’s foreign

operations from their functional currencies to the Group’s presentation currency (i.e. H) are recognised directly in the other comprehensive

income and accumulated in foreign currency translation reserve. Exchange difference in the foreign currency translation reserve are

reclassified to consolidated profit or loss on the disposal of the foreign operations.

206