Page 19 - Green Builder Nov-Dec 2020 Issue

P. 19

THE STATE OF

SUSTAINABLE

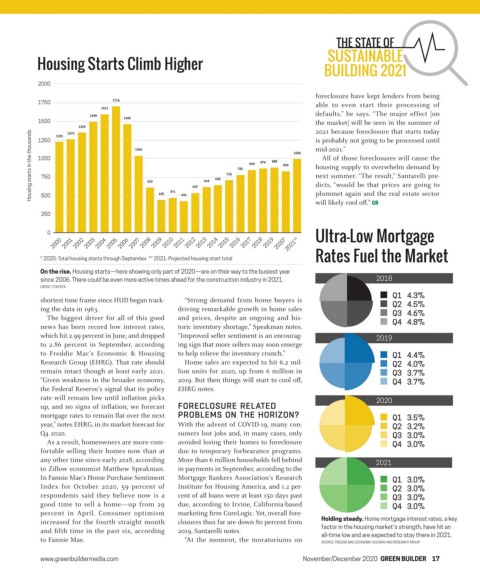

Housing Starts Climb Higher

BUILDING 2021

2000

foreclosure have kept lenders from being

1750 1716 able to even start their processing of

1611

defaults,” he says. “The major effect [on

1499

1500 1465 the market] will be seen in the summer of

1259 2021 because foreclosure that starts today

Housing starts in the thousands 1000 1046 622 618 648 715 782 849 876 888 830 1000 mid-2021.”

1273

1231

is probably not going to be processed until

1250

All of those foreclosures will cause the

housing supply to overwhelm demand by

next summer. “The result,” Santarelli pre-

750

dicts, “would be that prices are going to

537

plummet again and the real estate sector

471

500

445

431

will likely cool o.” GB

250

0 Ultra-Low Mortgage

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020* 2021**

* 2020: Total housing starts through September. ** 2021: Projected housing start total Rates Fuel the Market

On the rise. Housing starts—here showing only part of 2020—are on their way to the busiest year

since 2006. There could be even more active times ahead for the construction industry in 2021. 2018

CREDIT: STATISTA

Q1 4.3%

shortest time frame since HUD began track- “Strong demand from home buyers is Q2 4.5%

ing the data in 1963. driving remarkable growth in home sales Q3 4.6%

The biggest driver for all of this good and prices, despite an ongoing and his-

news has been record low interest rates, toric inventory shortage,” Speakman notes. Q4 4.8%

which hit 2.99 percent in June, and dropped “Improved seller sentiment is an encourag- 2019

to 2.86 percent in September, according ing sign that more sellers may soon emerge

to Freddie Mac’s Economic & Housing to help relieve the inventory crunch.” Q1 4.4%

Research Group (EHRG). That rate should Home sales are expected to hit 6.2 mil- Q2 4.0%

remain intact though at least early 2021. lion units for 2020, up from 6 million in Q3 3.7%

“Given weakness in the broader economy, 2019. But then things will start to cool o, Q4 3.7%

the Federal Reserve’s signal that its policy EHRG notes.

rate will remain low until ination picks 2020

up, and no signs of ination, we forecast FORECLOSURE RELATED

mortgage rates to remain at over the next PROBLEMS ON THE HORIZON? Q1 3.5%

year,” notes EHRG, in its market forecast for With the advent of COVID-19, many con- Q2 3.2%

Q4 2020. sumers lost jobs and, in many cases, only Q3 3.0%

As a result, homeowners are more com- avoided losing their homes to foreclosure Q4 3.0%

fortable selling their homes now than at due to temporary forbearance programs.

any other time since early 2018, according More than 6 million households fell behind 2021

to Zillow economist Matthew Speakman. in payments in September, according to the

In Fannie Mae’s Home Purchase Sentiment Mortgage Bankers Association’s Research Q1 3.0%

Index for October 2020, 59 percent of Institute for Housing America, and 1.2 per- Q2 3.0%

respondents said they believe now is a cent of all loans were at least 150 days past Q3 3.0%

good time to sell a home—up from 29 due, according to Irvine, California-based Q4 3.0%

percent in April. Consumer optimism marketing rm CoreLogic. Yet, overall fore-

increased for the fourth straight month closures thus far are down 80 percent from Holding steady. Home mortgage interest rates, a key

and fth time in the past six, according 2019, Santarelli notes. factor in the housing market’s strength, have hit an

to Fannie Mae. “At the moment, the moratoriums on all-time low and are expected to stay there in 2021.

SOURCE: FREDDIE MAC ECONOMIC HOUSING AND RESEARCH GROUP

www.greenbuildermedia.com November/December 2020 GREEN BUILDER 17

12-28, 32-36 GB 1120 State of the Industry.indd 17 12/10/20 6:49 PM