Page 107 - BFSI CHRONICLE 10 th Issue (2nd Annual Issue ) .indd

P. 107

BFSI Chronicle, 2 Annual Issue, 10 Edition July 2022

th

nd

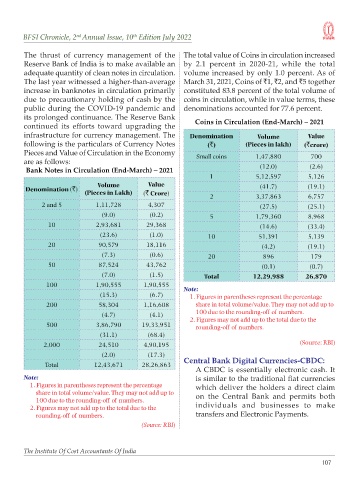

The thrust of currency management of the The total value of Coins in circulation increased

Reserve Bank of India is to make available an by 2.1 percent in 2020-21, while the total

adequate quantity of clean notes in circulation. volume increased by only 1.0 percent. As of

The last year witnessed a higher-than-average March 31, 2021, Coins of `1, `2, and `5 together

increase in banknotes in circulation primarily constituted 83.8 percent of the total volume of

due to precautionary holding of cash by the coins in circulation, while in value terms, these

public during the COVID-19 pandemic and denominations accounted for 77.6 percent.

its prolonged continuance. The Reserve Bank Coins in Circulation (End-March) – 2021

continued its efforts toward upgrading the

infrastructure for currency management. The Denomination Volume Value

following is the particulars of Currency Notes (`) (Pieces in lakh) (`crore)

Pieces and Value of Circulation in the Economy

Small coins 1,47,880 700

are as follows:

Bank Notes in Circulation (End-March) – 2021 (12.0) (2.6)

1 5,12,597 5,126

Volume Value (41.7) (19.1)

Denomination (`)

(Pieces in Lakh) (` Crore)

2 3,37,863 6,757

2 and 5 1,11,728 4,307 (27.5) (25.1)

(9.0) (0.2) 5 1,79,360 8,968

10 2,93,681 29,368 (14.6) (33.4)

(23.6) (1.0) 10 51,391 5,139

20 90,579 18,116 (4.2) (19.1)

(7.3) (0.6) 20 896 179

50 87,524 43,762 (0.1) (0.7)

(7.0) (1.5) Total 12,29,988 26,870

100 1,90,555 1,90,555

Note:

(15.3) (6.7) 1. Figures in parentheses represent the percentage

200 58,304 1,16,608 share in total volume/value. They may not add up to

100 due to the rounding-off of numbers.

(4.7) (4.1)

2. Figures may not add up to the total due to the

500 3,86,790 19,33,951

rounding-off of numbers.

(31.1) (68.4)

2,000 24,510 4,90,195 (Source: RBI)

(2.0) (17.3)

Central Bank Digital Currencies-CBDC:

Total 12,43,671 28,26,863

A CBDC is essentially electronic cash. It

Note: is similar to the traditional fiat currencies

1. Figures in parentheses represent the percentage which deliver the holders a direct claim

share in total volume/value. They may not add up to on the Central Bank and permits both

100 due to the rounding-off of numbers.

2. Figures may not add up to the total due to the individuals and businesses to make

rounding-off of numbers. transfers and Electronic Payments.

(Source: RBI)

The Institute Of Cost Accountants Of India

107