Page 5 - WSAAG081_Jumbo Booklet

P. 5

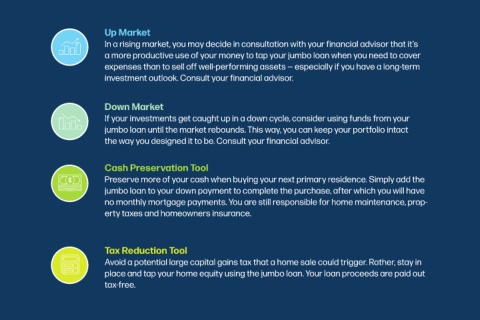

Up Market

In a rising market, you may decide in consultation with your financial advisor that it’s

a more productive use of your money to tap your jumbo loan when you need to cover

expenses than to sell off well-performing assets — especially if you have a long-term

investment outlook. Consult your financial advisor.

Down Market

If your investments get caught up in a down cycle, consider using funds from your

jumbo loan until the market rebounds. This way, you can keep your portfolio intact

the way you designed it to be. Consult your financial advisor.

Cash Preservation Tool

Preserve more of your cash when buying your next primary residence. Simply add the

jumbo loan to your down payment to complete the purchase, after which you will have

no monthly mortgage payments. You are still responsible for home maintenance, prop-

erty taxes and homeowners insurance.

Tax Reduction Tool

Avoid a potential large capital gains tax that a home sale could trigger. Rather, stay in

place and tap your home equity using the jumbo loan. Your loan proceeds are paid out

tax-free.