Page 15 - WSAAG052_Your Guide Booklet

P. 15

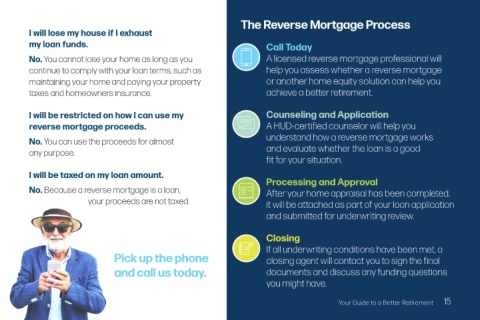

The Reverse Mortgage Process

I will lose my house if I exhaust

my loan funds. Call Today

No. You cannot lose your home as long as you A licensed reverse mortgage professional will

continue to comply with your loan terms, such as help you assess whether a reverse mortgage

maintaining your home and paying your property or another home equity solution can help you

taxes and homeowners insurance. achieve a better retirement.

I will be restricted on how I can use my Counseling and Application

reverse mortgage proceeds. A HUD-certified counselor will help you

No. You can use the proceeds for almost understand how a reverse mortgage works

any purpose. and evaluate whether the loan is a good

fit for your situation.

I will be taxed on my loan amount.

Processing and Approval

No. Because a reverse mortgage is a loan, After your home appraisal has been completed,

your proceeds are not taxed. it will be attached as part of your loan application

and submitted for underwriting review.

Closing

If all underwriting conditions have been met, a

Pick up the phone closing agent will contact you to sign the final

and call us today. documents and discuss any funding questions

you might have.

Your Guide to a Better Retirement 15