Page 22 - 2020 Buyer Package - Pallavi

P. 22

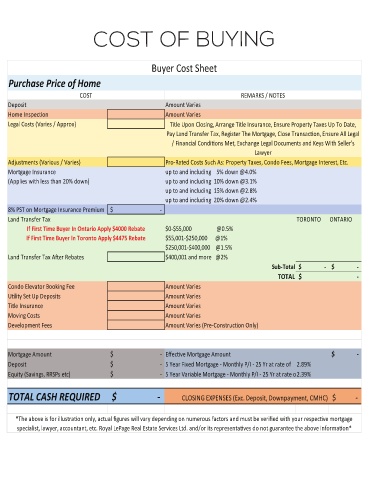

COST OF BUYING

Buyer Cost Sheet

Purchase Price of Home

COST REMARKS / NOTES

Deposit Amount Varies

Home Inspec�on Amount Varies

Review All Documents, Ensure No Claims Against Property, Ensure Valid and Clean

Legal Costs (Varies / Approx) Title Upon Closing, Arrange Title Insurance, Ensure Property Taxes Up To Date,

Pay Land Transfer Tax, Register The Mortgage, Close Transac�on, Ensure All Legal

/ Financial Condi�ons Met, Exchange Legal Documents and Keys With Seller’s

Lawyer

Adjustments (Various / Varies) Pro-Rated Costs Such As: Property Taxes, Condo Fees, Mortgage Interest, Etc.

Mortgage Insurance up to and including 5% down @4.0%

(Applies with less than 20% down) up to and including 10% down @3.1%

up to and including 15% down @2.8%

up to and including 20% down @2.4%

8% PST on Mortgage Insurance Premium $ -

Land Transfer Tax TORONTO ONTARIO

If First Time Buyer In Ontario Apply $4000 Rebate $0-$55,000 @0.5%

If First Time Buyer In Toronto Apply $4475 Rebate $55,001-$250,000 @1%

$250,001-$400,000 @1.5%

Land Transfer Tax A�er Rebates $400,001 and more @2%

Sub-Total $ $ -

-

TOTAL $ -

Condo Elevator Booking Fee Amount Varies

U�lity Set Up Deposits Amount Varies

Title Insurance Amount Varies

Moving Costs Amount Varies

Development Fees Amount Varies (Pre-Construc�on Only)

Mortgage Amount $ - Effec�ve Mortgage Amount $ -

Deposit $ - 5 Year Fixed Mortgage - Monthly P/I - 25 Yr at rate of 2.89%

Equity (Savings, RRSPs etc) $ - 5 Year Variable Mortgage - Monthly P/I - 25 Yr at rate of2.39%

TOTAL CASH REQUIRED $ - CLOSING EXPENSES (Exc. Deposit, Downpayment, CMHC) $ -

*The above is for illustra�on only, actual figures will vary depending on numerous factors and must be verified with your respec�ve mortgage

specialist, lawyer, accountant, etc. Royal LePage Real Estate Services Ltd. and/or its representa�ves do not guarantee the above informa�on*