Page 14 - Real Estate_Capabilities (US) Book

P. 14

Customized Analytics for

Data Driven Decisions

One of the most important things HUB can do for our clients is to help them determine and

deploy the optimal program structure for each of their insurable risks individually and/or all of

them collectively.

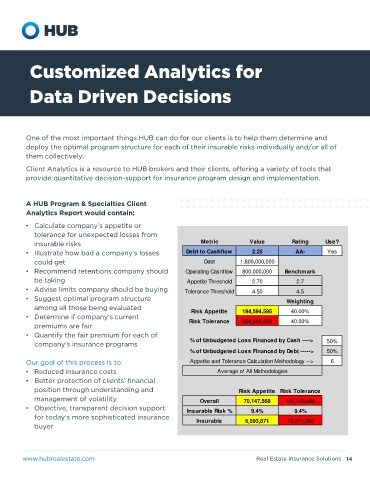

Client Analytics is a resource to HUB brokers and their clients, offering a variety of tools that

provide quantitative decision-support for insurance program design and implementation.

A HUB Program & Specialties Client

Analytics Report would contain:

•

tolerance for unexpected losses from

Metric Value Rating Use? insurable risks Value Rating Use? Metric Value Rating Use?

Metric

Days Cash on Hand 250.0 AA- Yes • Operating Margin 7.50% AA+ Yes Debt to Cashflow 2.25 AA- Yes

Revenues

Cash on Hand 125,000,000 could get 2,500,000,000 Debt 1,800,000,000

Daily Cash Need 500,000 Benchmark • Recommend retentions company should Operating Cashflow 800,000,000 Benchmark

Benchmark

Operating Income

187,500,000

be taking

Appetite Threshold 208.0 208.0 Appetite Threshold 3.00% 3.0% Appetite Threshold 2.70 2.7

Tolerance Threshold

Tolerance Threshold 156.0 156.0 • Advise limits company should be buying Tolerance Threshold 4.50 4.5

2.60%

2.6%

Weighting • Suggest optimal program structure Weighting

Weighting

among all those being evaluated

Risk Appetite 42,000,000 40.00% Risk Appetite 112,500,000 0.00% Risk Appetite 194,594,595 40.00%

•

Risk Tolerance 94,000,000 40.00% Risk Tolerance 122,500,000 0.00% Risk Tolerance 654,545,455 40.00%

premiums are fair

• Quantify the fair premium for each of

Metric Value Rating Use? Metric Value Rating Use? % of Unbudgeted Loss Financed by Cash ----> 50%

Current Ratio 2.22 A+ Yes EBIDA Margin 12.00% AA- Yes % of Unbudgeted Loss Financed by Debt -----> 50%

Revenues

Current Assets 1,000,000,000 Our goal of this process is to: Appetite and Tolerance Calculation Methodology --> 6

2,500,000,000

EBIDA

Current Liabilities 450,000,000 Benchmark • Reduced insurance costs Benchmark Average of All Methodologies

300,000,000

Appetite Threshold 2.00 2.0 • Appetite Threshold 11.20% 11.2%

position through understanding and

Tolerance Threshold 1.50 1.5 Tolerance Threshold 9.80% 9.8% Risk Appetite Risk Tolerance

Weighting management of volatility Weighting Overall 70,147,568 141,183,636

• Objective, transparent decision support

Risk Appetite 200,000,000 10.00% Risk Appetite 20,000,000 10.00% Insurable Risk % 9.4% 9.4%

Risk Tolerance 650,000,000 10.00% Risk Tolerance 55,000,000 10.00% Insurable 6,593,871 13,271,262

buyer

www.hubrealestate.com Real Estate Insurance Solutions 14