Page 159 - KGR 2020-21 Annual Report

P. 159

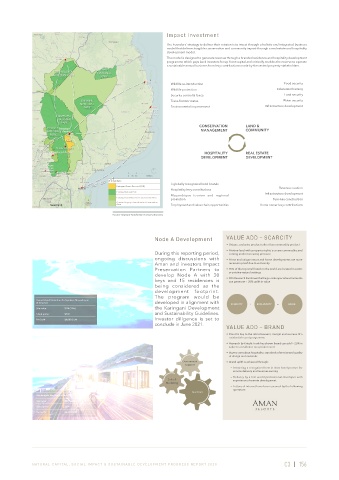

Impact Investment

The Founders’ strategy to deliver their mission is to invest through a holistic and integrated business

model that delivers tangible conservation and community impact through a real estate and hospitality

development model.

Singita

Pamushana

The model is designed to generate revenue through a branded residence and hospitality development

programme which pays back investors for up-front capital and critically enables the reserve to operate

a sustainable annual business from levy contributions made by the vested property stakeholders.

ZINAVE

GONAREZHOU NATIONAL

NATIONAL PARK

PARK

Vilanculos

Wildlife re-introduction Food security

Wildlife protection Education/training

Security control & fence Land security

BANHINE Trans-frontier status Water security

NATIONAL Infrastructure development

PARK Environmental improvement

Pomene

Marine

LIMPOPO Reserve

NATIONAL

PARK

CONSERVATION LAND &

KRUGER Massingir MANAGEMENT COMMUNITY

NATIONAL Airport

PARK KGR

JOHANNESBURG Singita Lebombo

Singita Ebony & Boulders

HOSPITALITY

DEVELOPMENT REAL ESTATE

DEVELOPMENT

Kruger

Mpumalanga

International

Airport Leopard Creek Golf

Club 0 20 40 100km

EUROPE / ASIA LEGEND 3 globally recognised hotel brands

Karingani Game Reserve (KGR) Revenue creation

Hospitality levy contributions

Existing National Park Infrastructure development

Mozambique tourism and regional

Existing Game Reserve / Conservation Area

promotion Turn-key construction

Greater Limpopo Transfrontier Conservation

Area Employment and value chain opportunities Home owner levy contributions

Greater Limpopo Transfrontier Conservation Area

Node A Development VALUE ADD – SCARCITY

• Unique, exclusive product rather than commodity product

• Pristine land with property rights is a rare commodity and

During this reporting period, coming under increasing pressure

ongoing discussions with • Prime and unique resort and home developments are more

Aman and investors Impact recession proof due to exclusivity

Preservation Partners to • 70% of the top small hotels in the world are located in exotic

develop Node A with 30 or pristine natural settings

keys and 15 residences is • ERA Research has shown that large-scale special environments

can generate > 30% uplift in value

being considered as the

development footprint.

The program would be

Vamizi Island, Quirimbas Archipelago, Mozambique

(& Beyond) developed in alignment with SCARCITY + EXCLUSIVITY = VALUE

Site value: $1 M (1 Ha) the Karingani Development

5 bed prime: $4 M and Sustainability Guidelines.

Per Sq M: $8,000 Sq M Investor diligence is set to

conclude in June 2021.

VALUE ADD – BRAND

• Brand is key to the attractiveness, margin and success of a

residential resort programme

• Research by Knight Frank has shown Brand can add > 25% in

value to a residence on a prime resort

• Buyers care about hospitality, standards of service and quality

of design and materials

Government • Brand uplift is achieved through:

support

− Attracting a recognised best in class hotel partner for

service delivery and revenue earning

− Delivery by a first world professional developer with

Sales & experience of remote development

Marketing

− Letters of interest have been secured by the following

operators:

Investors

Machangulo, Machangulo Reserve, Mozambique

Site value: $500,000 (2 Ha)

5 bed prime: $3 M

Per Sq M: $6,600 Sq M

NATURAL CAPITAL, SOCIAL IMP A CT & SUSTAINABLE DEVEL OPMENT PROGRESS REPORT 2020 C3 | 156