Page 219 - Corporate Finance PDF Final new link

P. 219

NPP

BRILLIANT’S Long Term Financing and Valuation of Goodwill & Shares 219

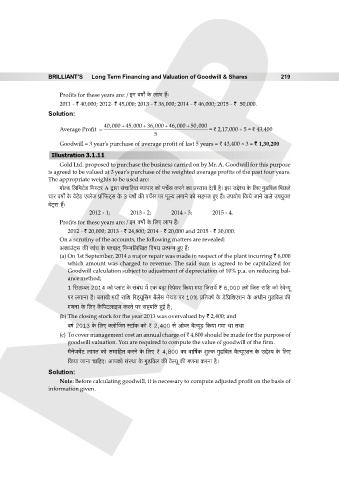

Profits for these years are: / BZ dfm] Ho$ bm^ h¢…

2011 - ` 40,000; 2012- ` 45,000; 2013 - ` 36,000; 2014 - ` 46,000; 2015 - ` 50,000.

Solution:

40,000 45,000 36,000 46,000 50,000

Average Profit = ` 2,17,000 ÷ 5 = ` 43,400

5

Goodwill = 3 year's purchase of average profit of last 5 years = ` 43,400 × 3 = ` 1,30,200

Illustration 3.1.11

Gold Ltd. proposed to purchase the business carried on by Mr. A. Goodwill for this purpose

is agreed to be valued at 3 year's purchase of the weighted average profits of the past four years.

The appropriate weights to be used are:

JmoëS> {b{‘Q>oS> {‘ñQ>a A Ûmam g§Mm{bV ì¶mnma H$mo nM}g H$aZo H$m àñVmd XoVr h¡& Bg CÔoí¶ Ho$ {bE JwS>{db {nN>bo

Mma dfm] Ho$ doQ>oS> EdaoO àm°{’$Q²>g Ho$ 3 dfm] H$s nM}g na ‘yë¶ bJmZo H$mo gh‘V hþE h¢& Cn¶moJ {H$¶o OmZo dmbo Cn¶w³V

doQ²>g h¢…

2012 - 1; 2013 - 2; 2014 - 3; 2015 - 4.

Profits for these years are: / BZ dfm] Ho$ {bE bm^ h¢…

2012 - ` 20,000; 2013 - ` 24,800; 2014 - ` 20,000 and 2015 - ` 30,000.

On a scrutiny of the accounts, the following matters are revealed:

AH$mC§Q²>g H$s Om§M Ho$ níMmV² {ZåZ{b{IV {df¶ CËnÝZ hwE h¢…

(a) On 1st September, 2014 a major repair was made in respect of the plant incurring ` 6,000

which amount was charged to revenue. The said sum is agreed to be capitalized for

Goodwill calculation subject to adjustment of depreciation of 10% p.a. on reducing bal-

ance method;

1 {gVå~a 2014 H$mo ßbm§Q> Ho$ g§~§Y ‘| EH$ ~‹S>m [ano¶a {H$¶m J¶m {Og‘| < 6,000 bJo {Og am{e H$mo aodoݶy

na bJmZm h¡& ~Vm¶r J¶r am{e [aS²>¶yqgJ ~¡b|g ‘oWS> na 10% à{Vdf© Ho$ S>o{à{eEeZ Ho$ AYrZ JwS>{db H$s

JUZm Ho$ {bE H¡${nQ>bmBO H$aZo na gh‘{V hþB© h¡;

(b) The closing stock for the year 2013 was overvalued by ` 2,400; and

df© 2013 Ho$ {bE ³bmoqOJ ñQ>m°H$ H$mo < 2,400 go Amoda d¡ë¶yS> {H$¶m J¶m Wm VWm

(c) To cover management cost an annual charge of ` 4,800 should be made for the purpose of

goodwill valuation. You are required to compute the value of goodwill of the firm.

‘¡ZoO‘|Q> bmJV H$mo g‘m{hV H$aZo Ho$ {bE < 4,800 H$m dm{f©H$ ewëH$ JwS>{db d¡ë¶yEeZ Ho$ CÔoí¶ Ho$ {bE

{H$¶m OmZm Mm{hE& AmnH$mo g§ñWm Ho$ JwS>{db H$s d¡ë¶y H$s JUZm H$aZm h¡&

Solution:

Note: Before calculating goodwill, it is necessary to compute adjusted profit on the basis of

information given.