Page 223 - Corporate Finance PDF Final new link

P. 223

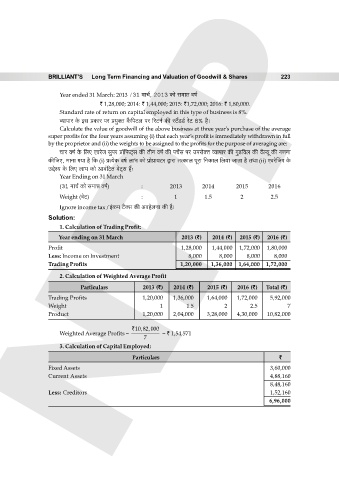

BRILLIANT’S Long Term Financing and Valuation of Goodwill & Shares 223

Year ended 31 March: 2013 / 31 ‘mM©, 2013 H$mo g‘má df©

` 1,28,000; 2014: ` 1,44,000; 2015: `1,72,000; 2016: ` 1,80,000.

Standard rate of return on capital employed in this type of business is 8%.

ì¶mnma Ho$ Bg àH$ma na à¶w³V H¡${nQ>b na [aQ>Z© H$s ñQ>¢S>S>© aoQ> 8% h¡&

Calculate the value of goodwill of the above business at three year's purchase of the average

super profits for the four years assuming (i) that each year’s profit is immediately withdrawn in full

by the proprietor and (ii) the weights to be assigned to the profits for the purpose of averaging are:

Mma df© Ho$ {bE EdaoO gwna àm°{’$Q²>g H$s VrZ df© H$s nM}g na Cnamo³V ì¶mnma H$s JwS>{db H$s d¡ë¶y H$s JUZm

H$s{OE, ‘mZm J¶m h¡ {H$ (i) à˶oH$ df© bm^ H$mo n«moàm¶Q>a Ûmam VËH$mb nyam {ZH$mb {b¶m OmVm h¡ VWm (ii) EdaoqOJ Ho$

CÔoí¶ Ho$ {bE bm^ H$mo Amd§{Q>V doQ²>g h¢…

Year Ending on 31 March

(31 ‘mM© H$mo g‘má df©) : 2013 2014 2015 2016

Weight (doQ>) : 1 1.5 2 2.5

Ignore income tax / B§H$‘ Q>¡³g H$s AdhobZm H$s h¡&

Solution: NPP

1. Calculation of Trading Profit:

Year ending on 31 March 2013 (`) 2014 (`) 2015 (`) 2016 (`)

Profit 1,28,000 1,44,000 1,72,000 1,80,000

Less: Income on Investment 8,000 8,000 8,000 8,000

Trading Profits 1,20,000 1,36,000 1,64,000 1,72,000

2. Calculation of Weighted Average Profit

Particulars 2013 (`) 2014 (`) 2015 (`) 2016 (`) Total (`)

Trading Profits 1,20,000 1,36,000 1,64,000 1,72,000 5,92,000

Weight 1 1.5 2 2.5 7

Product 1,20,000 2,04,000 3,28,000 4,30,000 10,82,000

` 10,82,000

Weighted Average Profits = = ` 1,54,571

7

3. Calculation of Capital Employed:

Particulars `

Fixed Assets 3,60,000

Current Assets 4,88,160

8,48,160

Less: Creditors 1,52,160

6,96,000