Page 225 - Corporate Finance PDF Final new link

P. 225

NPP

BRILLIANT’S Long Term Financing and Valuation of Goodwill & Shares 225

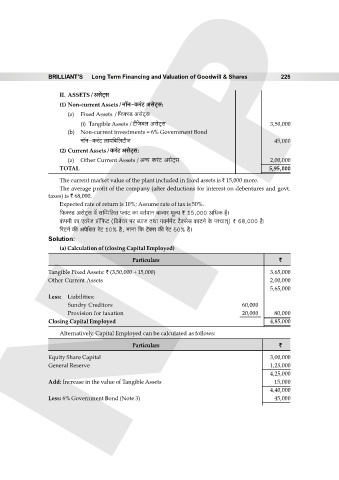

II. ASSETS / AgoQ²>g

(1) Non-current Assets / Zm°Z-H$a§Q> AgoQ²>g:

(a) Fixed Assets / {’$³ñS> AgoQ²>g

(i) Tangible Assets / Q>¢{O~b AgoQ²>g 3,50,000

(b) Non-current investments = 6% Government Bond

Zm°Z-H$a§Q> bm¶{~{bQ>rO 45,000

(2) Current Assets / H$a§Q> AgoQ²>g:

(a) Other Current Assets / Aݶ H$a§Q> AgoQ²>g 2,00,000

TOTAL 5,95,000

The current market value of the plant included in fixed assets is ` 15,000 more.

The average profit of the company (after deductions for interest on debentures and govt.

taxes) is ` 68,000.

Expected rate of return is 10%; Assume rate of tax is 50%.

{’$³ñS> AgoQ²>g ‘| gpå‘{bV ßbm§Q> H$m dV©‘mZ ~mOma ‘yë¶ < 15,000 A{YH$ h¡&

H§$nZr H$m EdaoO àm°{’$Q> ({S>~|Ma na ã¶mO VWm JdZ©‘|Q> Q>¡³gog H$mQ>Zo Ho$ níMmV²) < 68,000 h¡&

[aQ>Z© H$s Ano{jV aoQ> 10% h¡; ‘mZm {H$ Q>¡³g H$s aoQ> 50% h¡&

Solution:

(a) Calculation of (closing Capital Employed)

Particulars `

Tangible Fixed Assets: ` (3,50,000 + 15,000) 3,65,000

Other Current Assets 2,00,000

5,65,000

Less: Liabilities:

Sundry Creditors 60,000

Provision for taxation 20,000 80,000

Closing Capital Employed 4,85,000

Alternatively, Capital Employed can be calculated as follows:

Particulars `

Equity Share Capital 3,00,000

General Reserve 1,25,000

4,25,000

Add: Increase in the value of Tangible Assets 15,000

4,40,000

Less: 6% Government Bond (Note 3) 45,000