Page 342 - Corporate Finance PDF Final new link

P. 342

NPP

342 Corporate Finance BRILLIANT’S

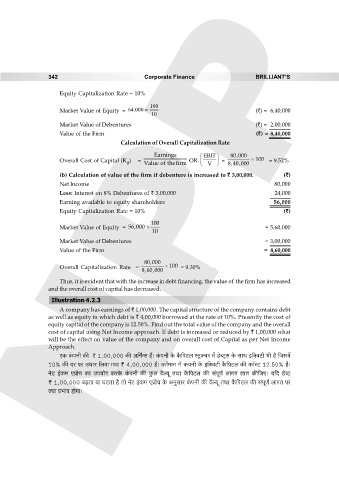

Equity Capitalization Rate = 10%

100

Market Value of Equity = 64, 000 (`) = 6,40,000

10

Market Value of Debentures (`) = 2,00,000

Value of the Firm (`) = 8,40,000

Calculation of Overall Capitalization Rate

Earnings EBIT 80,000

Overall Cost of Capital (K ) = OR = 100 = 9.52%

0 Value of thefirm V 8,40,000

(b) Calculation of value of the firm if debenture is increased to ` 3,00,000. (`)

Net Income 80,000

Less: Interest on 8% Debentures of ` 3,00,000 24,000

Earning available to equity shareholders 56,000

Equity Capitalization Rate = 10% (`)

100

Market Value of Equity = 56,000 = 5,60,000

10

Market Value of Debentures = 3,00,000

Value of the Firm = 8,60,000

80,000

Overall Capitalization Rate = 100 = 9.30% .

8,60,000

Thus, it is evident that with the increase in debt financing, the value of the firm has increased

and the overall cost of capital has decreased.

Illustration 4.2.3

A company has earnings of ` 1,00,000. The capital structure of the company contains debt

as well as equity in which debt is ` 4,00,000 borrowed at the rate of 10%. Presently the cost of

equity capital of the company is 12.50%. Find out the total value of the company and the overall

cost of capital using Net Income approach. If debt is increased or reduced by ` 1,00,000 what

will be the effect on value of the company and on overall cost of Capital as per Net Income

Approach.

EH$ H§$nZr H$s < 1,00,000 H$s A{Zª½g h¢& H§$nZr Ho$ H¡${nQ>b ñQ´>³Ma ‘| S>oãQ²>g Ho$ gmW B{³dQ>r ^r h¡ {Og‘|

10% H$s Xa na CYma {b¶m J¶m < 4,00,000 h¡& dV©‘mZ ‘| H§$nZr Ho$ B{³dQ>r H¡${nQ>b H$s H$m°ñQ> 12.50% h¡&

ZoQ> B§H$‘ EàmoM H$m Cn¶moJ H$aHo$ H§$nZr H$s Hw$b d¡ë¶y VWm H¡${nQ>b H$s g§nyU© bmJV kmV H$s{OE& ¶{X S>oãQ>

< 1,00,000 ~‹T>Vm ¶m KQ>Vm h¡ Vmo ZoQ> B§H$‘ En«moM Ho$ AZwgma H§$nZr H$s d¡ë¶y VWm H¡${nQ>b H$s g§nyU© bmJV na

³¶m à^md hmoJm&