Page 377 - Corporate Finance PDF Final new link

P. 377

BRILLIANT’S Leverage Analysis 377

It shows that every 1% change in sales will `h Xem©Vm h¡ {H$ {dH«$` _| 1% H$m n[adV©Z EBIT _|

change the EBIT by 4%. Hence, if sales is in- 4% n[adV©Z bm`oJmŸ& AV… `{X {dH«$` 25% ~‹T>Vm h¡ Vmo

creased by 25%, the EBIT will increase by 100% EBIT 100% ~‹T> Om`oJmŸ (AWm©V² XwJZm hmo Om`oJmŸ) VWm

and vice versa. We can see the effect of operat- `{X {dH«$` 25% KQ> OmEJm Vmo EBIT 100% KQ> OmEJmŸ

ing leverage on EBIT by changing sales as fol- (AWm©V² Oramo na Am OmEJm)& Am°naoqQ>J brdaoO Ho$ bm^

lows: na à^md H$mo {dH«$` _| n[adV©Z Ho$ _mÜ`_ go Bg àH$ma

g_Pm Om gH$Vm h¡…

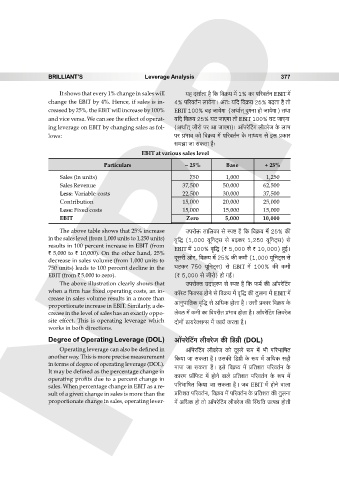

EBIT at various sales level

Particulars – 25% Base + 25%

Sales (in units) 750 1,000 1,250

Sales Revenue 37,500 50,000 62,500

Less: Variable costs 22,500 30,000 37,500

Contribution 15,000 20,000 25,000

Less: Fixed costs 15,000 15,000 15,000

EBIT NPP Zero 5,000 10,000

The above table shows that 25% increase Cnamoº$ Vm{bH$m go ñnï> h¡ {H$ {dH«$` _| 25% H$s

in the sales level (from 1,000 units to 1,250 units) d¥{Õ (1,000 `y{ZQ²>g go ~‹T>H$a 1,250 `y{ZQ²>g) go

results in 100 percent increase in EBIT (from

EBIT _| 100% d¥{Õ (` 5,000 go ` 10,000) hþB©Ÿ&

` 5,000 to ` 10,000). On the other hand, 25%

decrease in sales volume (from 1,000 units to Xygar Amoa, {dH«$` _| 25% H$s H$_r (1,000 `y{ZQ²>g go

750 units) leads to 100 percent decline in the KQ>H$a 750 `y{ZQ²>g) go EBIT _| 100% H$s H$_r

EBIT (from ` 5,000 to zero). (` 5,000 go Oramo) hmo JB©Ÿ&

The above illustration clearly shows that CnamoŠV CXmhaU go ñnï> h¡ {H$ \$_© H$s Am°naoqQ>J

when a firm has fixed operating costs, an in- H$m°ñQ> {\$ŠñS> hmoZo go {dH«$` _| d¥{Õ H$s VwbZm _| EBIT _|

crease in sales volume results in a more than

proportionate increase in EBIT. Similarly, a de- AmZwnm{VH$ d¥{Õ go A{YH$ hmoVm h¡Ÿ& Cgr àH$ma {dH«$` Ho$

crease in the level of sales has an exactly oppo- codc _| H$_r H$m {dnarV à^md hmoVm h¡Ÿ& Am°naoqQ>J {bdaoO

site effect. This is operating leverage which XmoZm| S>m`aoŠeÝg _| H$m`© H$aVm h¡Ÿ&

works in both directions.

Degree of Operating Leverage (DOL) Am°naoqQ>J brdaoO H$s {S>J«r (DOL)

Operating leverage can also be defined in Am°noa[Q>§J brdaoO H$mo Xygao ê$n _| ^r n[a^m{fV

another way. This is more precise measurement {H$`m Om gH$Vm h¡Ÿ& CgH$s {S>J«r Ho$ ê$n _| A{YH$ ghr

in terms of degree of operating leverage (DOL). _mnm Om gH$Vm h¡Ÿ& Bgo {dH«$` _| à{VeV n[adV©Z Ho$

It may be defined as the percentage change in H$maU àm°{\$Q> _| hmoZo dmbo à{VeV n[adV©Z Ho$ ê$n _|

operating profits due to a percent change in

n[a^m{fV {H$`m Om gH$Vm h¡Ÿ& O~ EBIT _| hmoZo dmbm

sales. When percentage change in EBIT as a re-

sult of a given change in sales is more than the à{VeV n[adV©Z, {dH«$` _| n[adV©Z Ho$ à{VeV H$s VwbZm

proportionate change in sales, operating lever- _| A{YH$ hmo Vmo Am°naoqQ>J brdaoO H$s pñW{V CËnÞ hmoVr