Page 393 - Corporate Finance PDF Final new link

P. 393

NPP

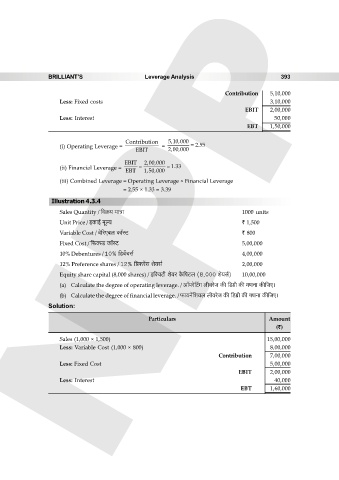

BRILLIANT’S Leverage Analysis 393

Contribution 5,10,000

Less: Fixed costs 3,10,000

EBIT 2,00,000

Less: Interest 50,000

EBT 1,50,000

Contribution 5,10,000

(i) Operating Leverage = = 2.55

EBIT 2,00,000

EBIT 2,00,000

(ii) Financial Leverage = 1.33

EBT 1,50,000

(iii) Combined Leverage = Operating Leverage × Financial Leverage

= 2.55 × 1.33 = 3.39

Illustration 4.3.4

Sales Quantity / {dH«$¶ ‘mÌm 1000 units

Unit Price / BH$mB© ‘yë¶ ` 1,500

Variable Cost / do[aE~b H$m°ñQ> ` 800

Fixed Cost / {’$³ñS> H$m°ñQ> 5,00,000

10% Debentures / 10% {S>~|Mg© 4,00,000

12% Preference shares / 12% {à’$a|g eo¶g© 2,00,000

Equity share capital (8,000 shares) / B{³dQ>r eo¶a H¡${nQ>b (8,000 eo¶g©) 10,00,000

(a) Calculate the degree of operating leverage. / Am°naoqQ>J brdaoO H$s {S>J«r H$s JUZm H$s{OE&

(b) Calculate the degree of financial leverage. / ’$m¶Zo§{e¶b brdaoO H$s {S>J«r H$s JUZm H$s{OE&

Solution:

Particulars Amount

(`)

Sales (1,000 × 1,500) 15,00,000

Less: Variable Cost (1,000 × 800) 8,00,000

Contribution 7,00,000

Less: Fixed Cost 5,00,000

EBIT 2,00,000

Less: Interest 40,000

EBT 1,60,000