Page 389 - Corporate Finance PDF Final new link

P. 389

NPP

BRILLIANT’S Leverage Analysis 389

tional cost and reduced sales volume due to ar-Am°J}ZmBOoeZ nr[a`S> Ho$ Xm¡amZ CgH$s Am` H$_ hmoJr

the adverse effect on the firm's goodwill. If liq- Š`m|{H$ \$_© Ho$ JwS>{db na ZH$mamË_H$ à^md Ho$ H$maU

uidation becomes unavoidable, the additional

cost incurred would result in a decline in net {dH«$` H$s _mÌm KQ>oJr Ed§ A{V[aº$ IM] hm|JoŸ& `{X g_mnZ

value of the firm's assets available to the share- A{Zdm`© hmo OmE Vmo cJZo dmcm A{V[aº$ H$m°ñQ> H«o${S>Q>a Ho$

holders after the creditor's claims have been Šco_ go ny{V© Ho$ ~mX eo`a hmoëS>g© H$mo CncãY H$amB© JB©

satisfied. Leverage has benefits as well as costs

- it is not an unmixed blessing. \$_© Ho$ AgoQ²>g H$s ZoQ> d¡ë`y H$_ hmo OmEJrŸ&

SOLVED PRACTICAL QUESTIONS

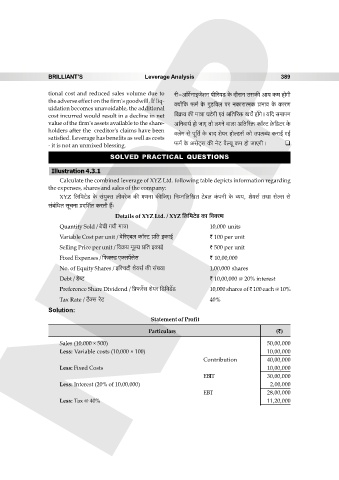

Illustration 4.3.1

Calculate the combined leverage of XYZ Ltd. following table depicts information regarding

the expenses, shares and sales of the company:

XYZ {b{‘Q>oS> Ho$ g§¶w³V brdaoO H$s JUZm H$s{OE& {ZåZ{b{IV Q>o~b H§$nZr Ho$ 춶, eo¶g© VWm goëg go

g§~§{YV gyMZm àX{e©V H$aVr h¢…

Details of XYZ Ltd. / XYZ {b{‘Q>oS> H$m {ddaU

Quantity Sold / ~oMr J¶r ‘mÌm 10,000 units

Variable Cost per unit / do[aE~b H$m°ñQ> à{V BH$mB© ` 100 per unit

Selling Price per unit / {dH«$¶ ‘yë¶ à{V BH$mB© ` 500 per unit

Fixed Expenses / {’$³ñS> E³gn|gog ` 10,00,000

No. of Equity Shares / B{³dQ>r eo¶g© H$s g§»¶m 1,00,000 shares

Debt / S>oãQ> ` 10,00,000 @ 20% interest

Preference Share Dividend / {à’$a|g eo¶a {S>{dS>|S> 10,000 shares of ` 100 each @ 10%

Tax Rate / Q>¡³g aoQ> 40%

Solution:

Statement of Profit

Particulars (`)

Sales (10,000 × 500) 50,00,000

Less: Variable costs (10,000 × 100) 10,00,000

Contribution 40,00,000

Less: Fixed Costs 10,00,000

EBIT 30,00,000

Less: Interest (20% of 10,00,000) 2,00,000

EBT 28,00,000

Less: Tax @ 40% 11,20,000