Page 401 - Corporate Finance PDF Final new link

P. 401

NPP

BRILLIANT’S Leverage Analysis 401

PRACTICAL QUESTIONS

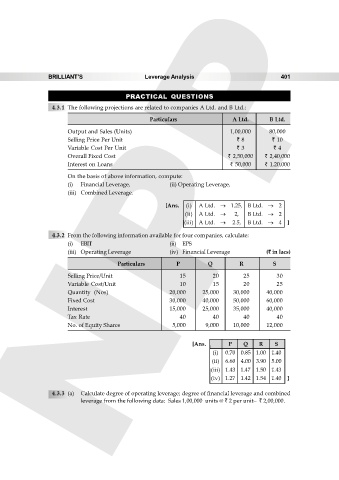

4.3.1 The following projections are related to companies A Ltd. and B Ltd.:

Particulars A Ltd. B Ltd.

Output and Sales (Units) 1,00,000 80,000

Selling Price Per Unit ` 8 ` 10

Variable Cost Per Unit ` 3 ` 4

Overall Fixed Cost ` 2,50,000 ` 2,40,000

Interest on Loans ` 50,000 ` 1,20,000

On the basis of above information, compute:

(i) Financial Leverage, (ii) Operating Leverage,

(iii) Combined Leverage.

[Ans. (i) A Ltd. 1.25, B Ltd. 2

(ii) A Ltd. 2, B Ltd. 2

(iii) A Ltd. 2.5, B Ltd. 4 ]

4.3.2 From the following information available for four companies, calculate:

(i) EBIT (ii) EPS

(iii) Operating Leverage (iv) Financial Leverage (` in lacs)

Particulars P Q R S

Selling Price/Unit 15 20 25 30

Variable Cost/Unit 10 15 20 25

Quantity (Nos) 20,000 25,000 30,000 40,000

Fixed Cost 30,000 40,000 50,000 60,000

Interest 15,000 25,000 35,000 40,000

Tax Rate 40 40 40 40

No. of Equity Shares 5,000 9,000 10,000 12,000

[Ans. P Q R S

(i) 0.70 0.85 1.00 1.40

(ii) 6.60 4.00 3.90 5.00

(iii) 1.43 1.47 1.50 1.43

(iv) 1.27 1.42 1.54 1.40 ]

4.3.3 (a) Calculate degree of operating leverage; degree of financial leverage and combined

leverage from the following data: Sales 1,00,000 units @ ` 2 per unit– ` 2,00,000.