Page 3 - Management Accounts Jan 2017

P. 3

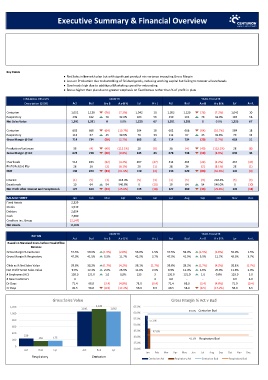

Executive Summary & Financial Overview

Key Points

● Net Sales in line with plan but with significant product mix variance impacting Gross Margin

● Loss on Production due to destocking of finished goods, reducing working capital but failing to recover all overheads

● Overheads high due to additional Marketing spend for rebranding

● Bonus higher than plan due to greater emphasis on fixed bonus rather than % of profit in plan

FINANCIAL RESULTS MONTH YEAR-TO-DATE

Description £(000) Act Bud A v B A v B % Lyr A v L Act Bud A v B A v B % Lyr A v L

Centurion 1,052 1,129 (76) (7.2%) 1,042 10 1,052 1,129 (76) (7.2%) 1,042 10

Respiratory 239 162 76 32.0% 183 56 239 162 76 32.0% 183 56

Net Sales Value 1,291 1,291 0 0.0% 1,225 67 1,291 1,291 0 0.0% 1,225 67

Centurion 602 666 (64) (10.7%) 584 18 602 666 (64) (10.7%) 584 18

Respiratory 112 67 45 39.9% 79 33 112 67 45 39.9% 79 33

Gross Margin @ Std 714 734 (20) (2.7%) 663 51 714 734 (20) (2.7%) 663 51

Production Variances 36 (4) (40) (112.1%) 28 (8) 36 (4) (40) (112.1%) 28 (8)

Gross Margin @ Act 678 738 (60) (8.8%) 635 43 678 738 (60) (8.8%) 635 43

Overheads 514 493 (22) (4.2%) 467 (47) 514 493 (22) (4.2%) 467 (47)

Profit Related Pay 28 26 (2) (8.1%) 28 (1) 28 26 (2) (8.1%) 28 (1)

EBIT 136 220 (84) (61.6%) 140 (4) 136 220 (84) (61.6%) 140 (4)

Interest (1) (5) (3) 218.4% (5) (3) (1) (5) (3) 218.4% (5) (3)

Excetionals 10 64 54 540.0% 0 (10) 10 64 54 540.0% 0 (10)

Net Profit after Interest and Exceptionals 127 160 (33) (25.8%) 145 (18) 127 160 (33) (25.8%) 145 (18)

BALANCE SHEET Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Fixed Assets 2,229

Stocks 1,519

Debtors 2,654

Cash 7,390

Creditors inc. Group (2,147)

Net Assets 11,645

MONTH YEAR-TO-DATE

RATIOS

Act Bud A v B A v B % Lyr A v L Act Bud A v B A v B % Lyr A v L

Based on Standard Costs before Head Office

Rebates

Gross Margin % Centurion 57.5% 59.0% (1.5%) (2.6%) 56.0% 1.5% 57.5% 59.0% (1.5%) (2.6%) 56.0% 1.5%

Gross Margin % Respiratory 47.0% 41.5% 5.5% 11.7% 43.3% 3.7% 47.0% 41.5% 5.5% 11.7% 43.3% 3.7%

Ohds as % Net Sales Value 39.8% 38.2% (1.7%) (4.2%) 38.1% (1.7%) 39.8% 38.2% (1.7%) (4.2%) 38.1% (1.7%)

Net Profit % Net Sales Value 9.9% 12.4% 2.6% 25.9% 11.8% 2.0% 9.9% 12.4% 2.6% 25.9% 11.8% 2.0%

# Employees (HC) 130.0 131.0 1.0 0.8% 133 3 130.0 131.0 1.0 0.8% 133.0 3.0

# New Customers 4 - - - 4 4.0 - - - 0.0 4.0

Dr Days 71.4 68.0 (3.4) (4.8%) 71.0 (0.4) 71.4 68.0 (3.4) (4.8%) 71.0 (0.4)

Cr Days 49.5 58.0 (8.5) (17.2%) 56.0 6.5 49.5 58.0 (8.5) (17.2%) 56.0 6.5

Gross Sales Value Gross Margin % Act v Bud

1,200 1,141 65.0%

1,061 1,062

59.0% Centurion Bud

1,000 60.0%

55.0%

800 57.5%

50.0%

600

45.0% 47.0%

400

239 40.0%

162 175 41.5% Respiratory Bud

200

35.0%

0

Act Bud Lyr Act Bud Lyr 30.0%

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Respiratory Centurion

Centurion Act Repiratory Act Centurion Bud Respiratory Bud