Page 136 - pwc-lease-accounting-guide_Neat

P. 136

Accounting for leases

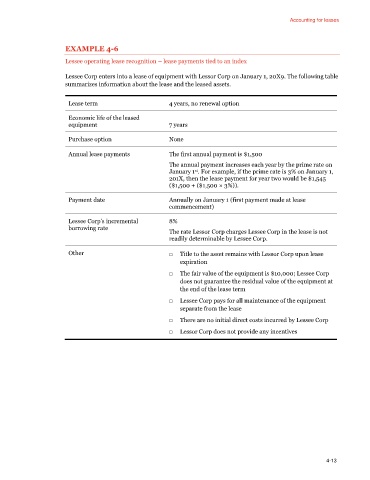

EXAMPLE 4-6

Lessee operating lease recognition – lease payments tied to an index

Lessee Corp enters into a lease of equipment with Lessor Corp on January 1, 20X9. The following table

summarizes information about the lease and the leased assets.

Lease term 4 years, no renewal option

Economic life of the leased

equipment 7 years

Purchase option None

Annual lease payments The first annual payment is $1,500

The annual payment increases each year by the prime rate on

January 1 . For example, if the prime rate is 3% on January 1,

st

201X, then the lease payment for year two would be $1,545

($1,500 + ($1,500 × 3%)).

Payment date Annually on January 1 (first payment made at lease

commencement)

Lessee Corp’s incremental 8%

borrowing rate

The rate Lessor Corp charges Lessee Corp in the lease is not

readily determinable by Lessee Corp.

Other □ Title to the asset remains with Lessor Corp upon lease

expiration

□ The fair value of the equipment is $10,000; Lessee Corp

does not guarantee the residual value of the equipment at

the end of the lease term

□ Lessee Corp pays for all maintenance of the equipment

separate from the lease

□ There are no initial direct costs incurred by Lessee Corp

□ Lessor Corp does not provide any incentives

4-13