Page 135 - pwc-lease-accounting-guide_Neat

P. 135

Accounting for leases

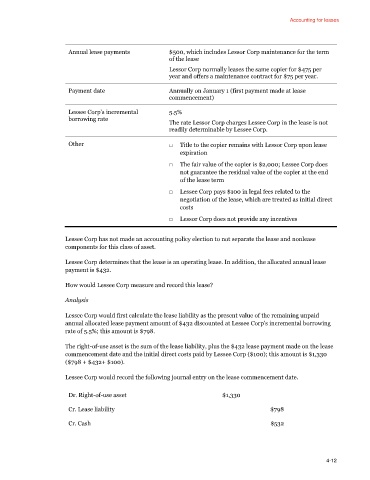

Annual lease payments $500, which includes Lessor Corp maintenance for the term

of the lease

Lessor Corp normally leases the same copier for $475 per

year and offers a maintenance contract for $75 per year.

Payment date Annually on January 1 (first payment made at lease

commencement)

Lessee Corp’s incremental 5.5%

borrowing rate

The rate Lessor Corp charges Lessee Corp in the lease is not

readily determinable by Lessee Corp.

Other □ Title to the copier remains with Lessor Corp upon lease

expiration

□ The fair value of the copier is $2,000; Lessee Corp does

not guarantee the residual value of the copier at the end

of the lease term

□ Lessee Corp pays $100 in legal fees related to the

negotiation of the lease, which are treated as initial direct

costs

□ Lessor Corp does not provide any incentives

Lessee Corp has not made an accounting policy election to not separate the lease and nonlease

components for this class of asset.

Lessee Corp determines that the lease is an operating lease. In addition, the allocated annual lease

payment is $432.

How would Lessee Corp measure and record this lease?

Analysis

Lessee Corp would first calculate the lease liability as the present value of the remaining unpaid

annual allocated lease payment amount of $432 discounted at Lessee Corp’s incremental borrowing

rate of 5.5%; this amount is $798.

The right-of-use asset is the sum of the lease liability, plus the $432 lease payment made on the lease

commencement date and the initial direct costs paid by Lessee Corp ($100); this amount is $1,330

($798 + $432+ $100).

Lessee Corp would record the following journal entry on the lease commencement date.

Dr. Right-of-use asset $1,330

Cr. Lease liability $798

Cr. Cash $532

4-12