Page 14 - pwc-lease-accounting-guide_Neat

P. 14

Introduction

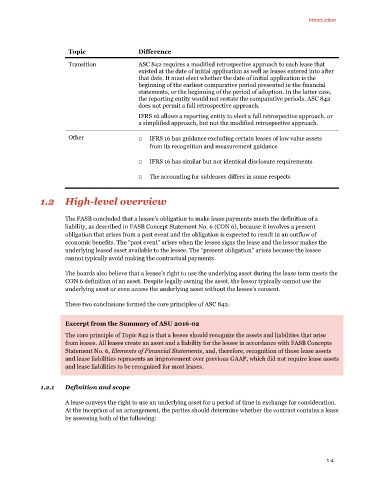

Topic Difference

Transition ASC 842 requires a modified retrospective approach to each lease that

existed at the date of initial application as well as leases entered into after

that date. It must elect whether the date of initial application is the

beginning of the earliest comparative period presented in the financial

statements, or the beginning of the period of adoption. In the latter case,

the reporting entity would not restate the comparative periods. ASC 842

does not permit a full retrospective approach.

IFRS 16 allows a reporting entity to elect a full retrospective approach, or

a simplified approach, but not the modified retrospective approach.

Other □ IFRS 16 has guidance excluding certain leases of low value assets

from its recognition and measurement guidance

□ IFRS 16 has similar but not identical disclosure requirements

□ The accounting for subleases differs in some respects

1.2 High-level overview

The FASB concluded that a lessee’s obligation to make lease payments meets the definition of a

liability, as described in FASB Concept Statement No. 6 (CON 6), because it involves a present

obligation that arises from a past event and the obligation is expected to result in an outflow of

economic benefits. The “past event” arises when the lessee signs the lease and the lessor makes the

underlying leased asset available to the lessee. The “present obligation” arises because the lessee

cannot typically avoid making the contractual payments.

The boards also believe that a lessee’s right to use the underlying asset during the lease term meets the

CON 6 definition of an asset. Despite legally owning the asset, the lessor typically cannot use the

underlying asset or even access the underlying asset without the lessee’s consent.

These two conclusions formed the core principles of ASC 842.

Excerpt from the Summary of ASU 2016-02

The core principle of Topic 842 is that a lessee should recognize the assets and liabilities that arise

from leases. All leases create an asset and a liability for the lessee in accordance with FASB Concepts

Statement No. 6, Elements of Financial Statements, and, therefore, recognition of those lease assets

and lease liabilities represents an improvement over previous GAAP, which did not require lease assets

and lease liabilities to be recognized for most leases.

1.2.1 Definition and scope

A lease conveys the right to use an underlying asset for a period of time in exchange for consideration.

At the inception of an arrangement, the parties should determine whether the contract contains a lease

by assessing both of the following:

1-4