Page 13 - Your New Medical Plans with Centivo

P. 13

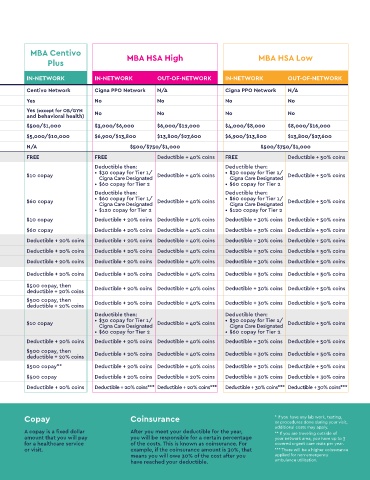

Medical Plan Comparison Chart

MBA Centivo

Plus MBA HSA High MBA HSA Low

IN-NETWORK IN-NETWORK OUT-OF-NETWORK IN-NETWORK OUT-OF-NETWORK

Network Centivo Network Cigna PPO Network N/A Cigna PPO Network N/A

Activation / PCP selection required Yes No No No No

Yes (except for OB/GYN

PCP referrals to specialists required No No No No

Plan features and behavioral health)

Deductible (individual / family) $500/$1,000 $3,000/$6,000 $6,000/$12,000 $4,000/$8,000 $8,000/$16,000

Out-of-Pocket Maximum (individual / family) $5,000/$10,000 $6,900/$13,800 $13,800/$27,600 $6,900/$13,800 $13,800/$27,600

Employer HSA contribution (employee only / employee + 1 / family) N/A $500/$750/$1,000 $500/$750/$1,000

Preventive care Preventive care (annual physical, immunizations, and screenings)* FREE FREE Deductible + 40% coins FREE Deductible + 50% coins

Deductible then: Deductible then:

• $30 copay for Tier 1/ • $30 copay for Tier 1/

Office visit (primary care)* $10 copay Deductible + 40% coins Deductible + 50% coins

Cigna Care Designated Cigna Care Designated

• $60 copay for Tier 2 • $60 copay for Tier 2

Deductible then: Deductible then:

Office visits Office visit (specialist)* $60 copay • $60 copay for Tier 1/ Deductible + 40% coins • $60 copay for Tier 1/ Deductible + 50% coins

Cigna Care Designated Cigna Care Designated

• $120 copay for Tier 2 • $120 copay for Tier 2

Behavioral health - individual therapy (no referral required) $10 copay Deductible + 20% coins Deductible + 40% coins Deductible + 30% coins Deductible + 50% coins

Therapeutic services (physical, occupational, speech therapy) $60 copay Deductible + 20% coins Deductible + 40% coins Deductible + 30% coins Deductible + 50% coins

Lab work Deductible + 20% coins Deductible + 20% coins Deductible + 40% coins Deductible + 30% coins Deductible + 50% coins

Diagnostic procedures Basic imaging (such as X-rays) Deductible + 20% coins Deductible + 20% coins Deductible + 40% coins Deductible + 30% coins Deductible + 50% coins

Advanced imaging (such as MRIs and PET scans) Deductible + 20% coins Deductible + 20% coins Deductible + 40% coins Deductible + 30% coins Deductible + 50% coins

Surgeries - professional services (inpatient or outpatient) (includes services from Deductible + 20% coins Deductible + 20% coins Deductible + 40% coins Deductible + 30% coins Deductible + 50% coins

all healthcare professionals such as surgeons, anesthesiologists, nurses, etc.)

Hospital and outpatient facilities Surgeries - facility charges (inpatient or outpatient) $500 copay, then Deductible + 20% coins Deductible + 40% coins Deductible + 30% coins Deductible + 50% coins

deductible + 20% coins

$500 copay, then

Hospital stays Deductible + 20% coins Deductible + 40% coins Deductible + 30% coins Deductible + 50% coins

deductible + 20% coins

Deductible then: Deductible then:

• $30 copay for Tier 1/ • $30 copay for Tier 1/

Office visits $10 copay Deductible + 40% coins Deductible + 50% coins

Cigna Care Designated Cigna Care Designated

• $60 copay for Tier 2 • $60 copay for Tier 2

Pregnancy expenses

Childbirth/delivery professional services Deductible + 20% coins Deductible + 20% coins Deductible + 40% coins Deductible + 30% coins Deductible + 50% coins

$500 copay, then

Childbirth/delivery facility services Deductible + 20% coins Deductible + 40% coins Deductible + 30% coins Deductible + 50% coins

deductible + 20% coins

Urgent care visits (no referral required) $500 copay** Deductible + 20% coins Deductible + 40% coins Deductible + 30% coins Deductible + 50% coins

Emergency care Emergency room $500 copay Deductible + 20% coins Deductible + 20% coins Deductible + 30% coins Deductible + 30% coins

Ambulance Deductible + 20% coins Deductible + 20% coins*** Deductible + 20% coins*** Deductible + 30% coins*** Deductible + 30% coins***

Defining Deductible Out-of-pocket maximum Copay Coinsurance * If you have any lab work, testing,

or procedures done during your visit,

additional costs may apply.

key terms: A deductible is the To protect you in the event of significant A copay is a fixed dollar After you meet your deductible for the year, ** If you are traveling outside of

medical expenses, all three plan options offer an

you will be responsible for a certain percentage

amount that you will pay

portion you must pay

out-of-pocket before annual out-of-pocket maximum (including the for a healthcare service of the costs. This is known as coinsurance. For your network area, you have up to 3

covered urgent care visits per year.

the plan pays for your deductible and any copays or coinsurance paid). or visit. example, if the coinsurance amount is 30%, that *** There will be a higher coinsurance

healthcare expenses. This is the most you will pay for any covered means you will owe 30% of the cost after you applied for non-emergency

healthcare expenses during the plan year. have reached your deductible. ambulance utilization.