Page 100 - Amata-one-report2020-en

P. 100

100

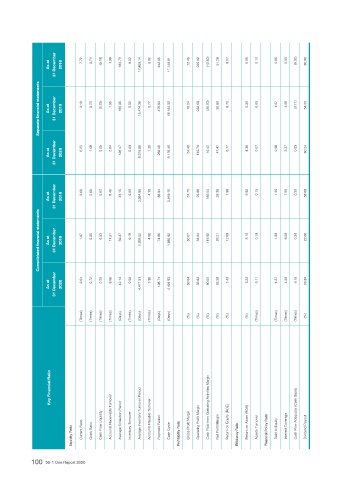

31 December 2018 17,409.14 17,149.91

As at 7.72 0.74 (0.19) 1.99 183.73 0.02 0.82 442.95 72.45 235.82 (10.50) 51.28 9.07 5.96 0.10 0.96 5.55 (0.03) 80.90

Separate financial statements As at 31 December 2019 2.18 0.23 (0.22) 1.95 186.95 0.02 15,474.30 0.77 476.93 15,184.32 70.24 230.58 (35.70) 50.82 8.72 5.38 0.09 1.07 4.06 (0.17) 54.03

31 December 2020

As at 6.23 1.69 0.05 2.84 128.47 0.04 9,316.96 1.36 268.96 9,176.46 64.48 145.79 10.42 47.47 6.77 4.38 0.07 0.98 3.37 0.03 60.24

As at 31 December 2018 2.66 0.65 0.62 8.46 43.15 0.09 3,964.95 4.10 88.94 3,919.16 51.75 25.88 166.04 22.38 7.98 5.92 0.15 1.35 7.50 0.30 58.68

Consolidated financial statements As at 31 December 2019 1.97 0.55 0.53 11.31 32.27 0.19 1,928.52 4.88 74.86 1,885.92 50.67 34.84 115.92 28.21 12.89 8.16 0.18 1.38 8.58 0.38 22.66

As at 31 December 2020 2.64 0.72 0.25 8.66 42.14 0.08 4,471.51 3.36 108.71 4,404.93 50.84 33.82 80.00 25.38 7.43 5.23 0.11 1.37 4.59 0.16 33.84

(Times) (Times) (Times) (Times) (Days) (Times) (Days) (Times) (Days) (Days) (%) (%) (%) (%) (%) (%) (Times) (Times) (Times) (Times) (%)

Key Financial Ratio Cash Flow from Operating Activities Margin

Liquidity Ratio Current Ratio Quick Ratio Cash Flow Liquidity Accounts Receivable Turnover Average Collection Period Inventory Turnover Average Inventory Turnover Period Accounts Payable Turnover Payment Period Cash Cycle Profitability Ratio Gross Profit Margin Operating Profit Margin Net Profit Margin Return on Equity (ROE) Efficiency Ratio Return on Asset (ROA) Assets Turnover Financial Policy Ratio Debt to Equity Interest

100 56-1 One Report 2020